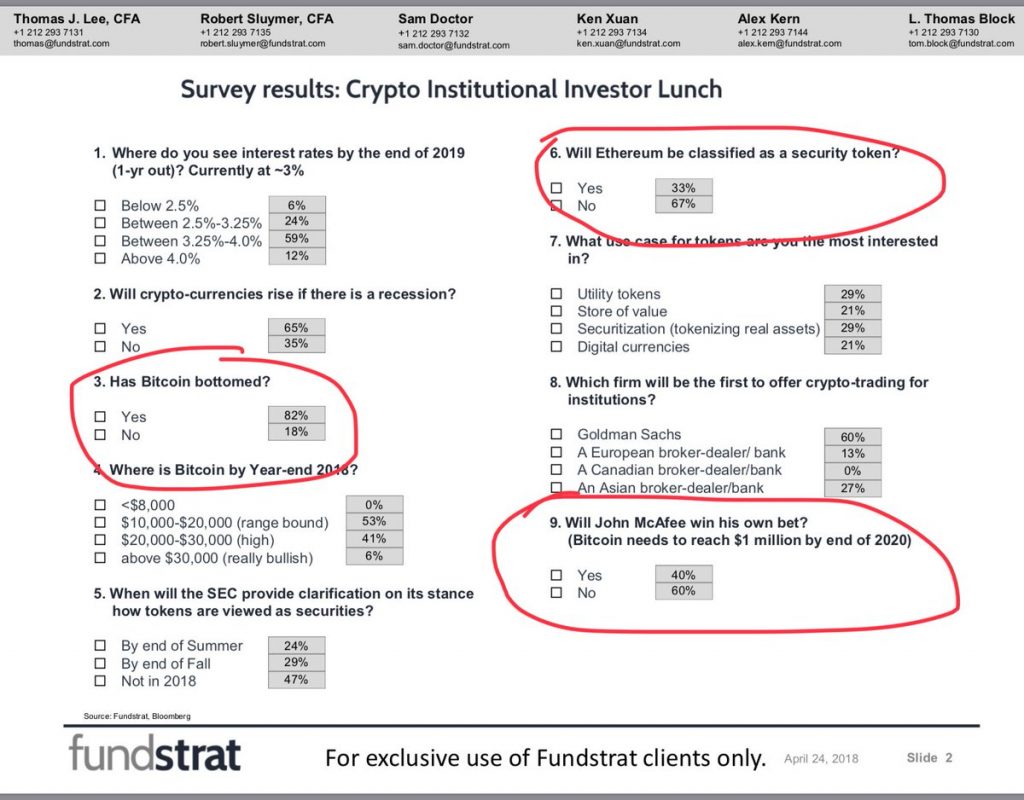

When Fundstrat Global speaks, the crypto world listens. In recent months it has been a steady font of good news for the ecosystem, with five figure price calls to predicting a very bright future, a crypto future. Resident guru Thomas Lee more-or-less foretold the current after tax season spike in prices when many others were decidedly bearish on the asset class. The firm recently surveyed a small group of institutional investors, and they appear to see cryptocurrencies poised for a breakout year. To help such investors make informed choices in that regard, the company also created five new crypto indices.

Also read: Bitcoin Markets Steady for Another Gox Dump, 16,000 Coins Moved by Trustee

Inflows of Big Money into Crypto

Fundstrat’s co-founder, Thomas Lee, tweeted how his company “hosted a small group of institutional investors” recently. It was a “mix of crypto and traditional macro [hedge funds] long-only.” It was a chance to informally survey basic sentiment about the market shortly after the end of tax season for the United States.

Of the nine questions, they included: if cryptos will rise during a recession (65% Yes), if bitcoin core had bottomed (82% Yes), bitcoin core’s year-end price (vast majority believed it will be between $10K and $30K); most believed regulators will provide clarity sometime this year; they do not believe Ethereum will be classified as a security; a great number seem to be moving away from “store of value” concerns, toward an actual currency; and 60% believe Goldman Sachs will be the first to introduce institutional crypto trades. The key “takeaway,” Mr. Lee insists, is how “institutions believe [bitcoin core] bottomed. We see this as a leading indicator for inflows of big money into Crypto.”

Indeed, Fundstrat’s Mr. Lee has