Publish date:

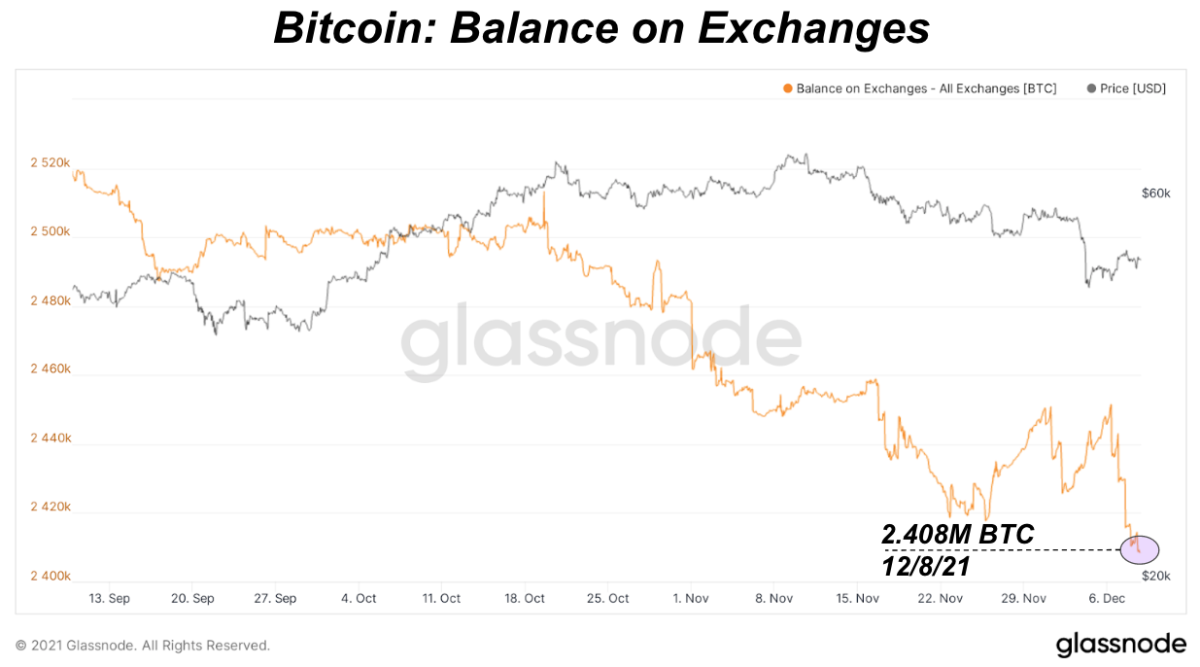

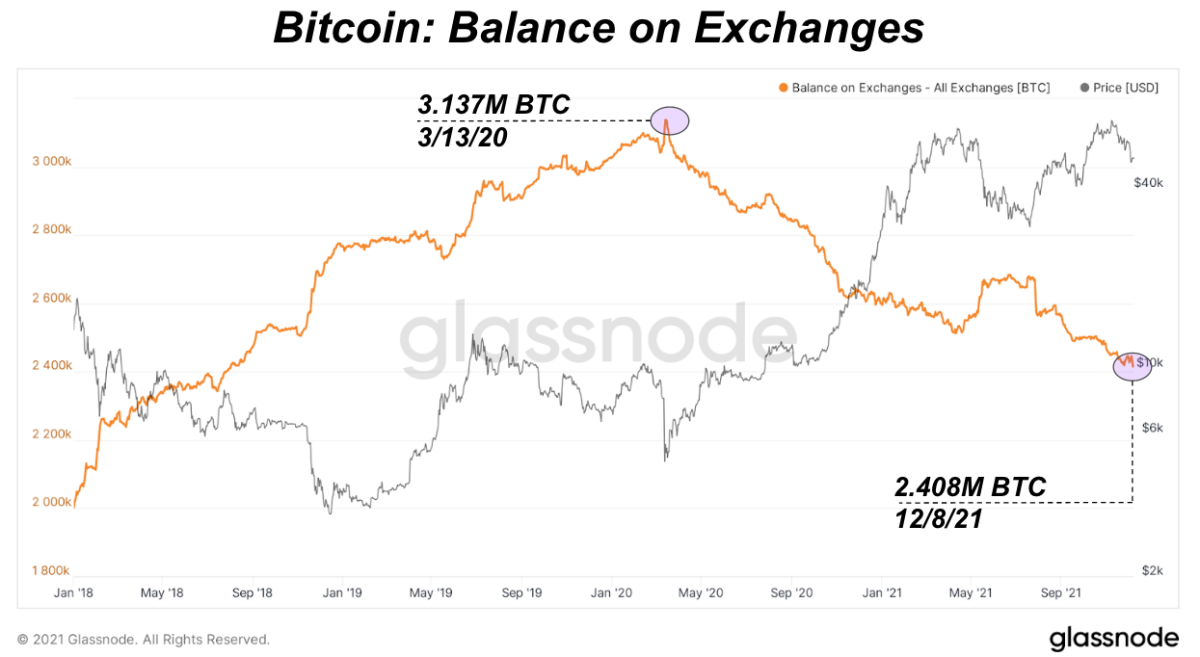

The total bitcoin on exchanges has hit another three-year low, with 2,408,237 BTC reported.

Author:

The total bitcoin on exchanges has hit another three-year low, with 2,408,237 BTC reported.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now[2].

Total bitcoin on exchanges has hit another three-year low today, with 2,408,237 BTC across all reported exchanges.

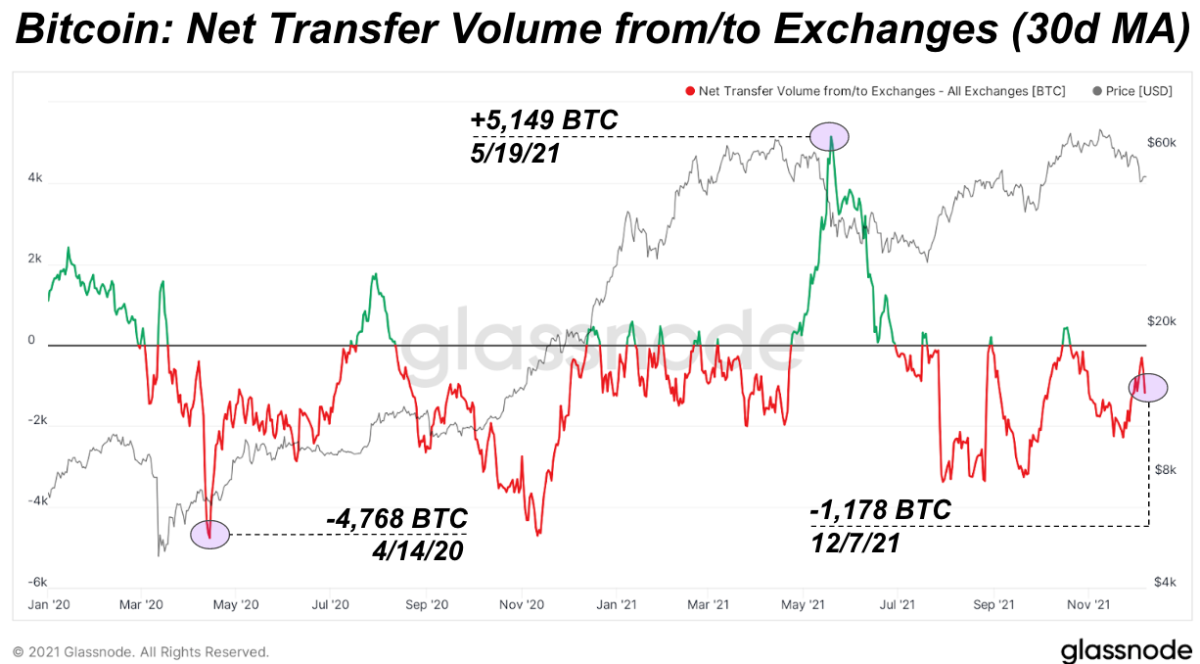

When looking at the net daily transfer volume on exchanges with a 30-day moving average applied, it can be seen how different this recent sell-off and subsequent derivatives market liquidation was compared to the one seen in April/May.

During the May sell-off, 5,149 BTC were deposited per day on average during the peak of the sell-off. Comparatively, today 1,178 BTC have been withdrawn from exchanges per day on average over the last month.

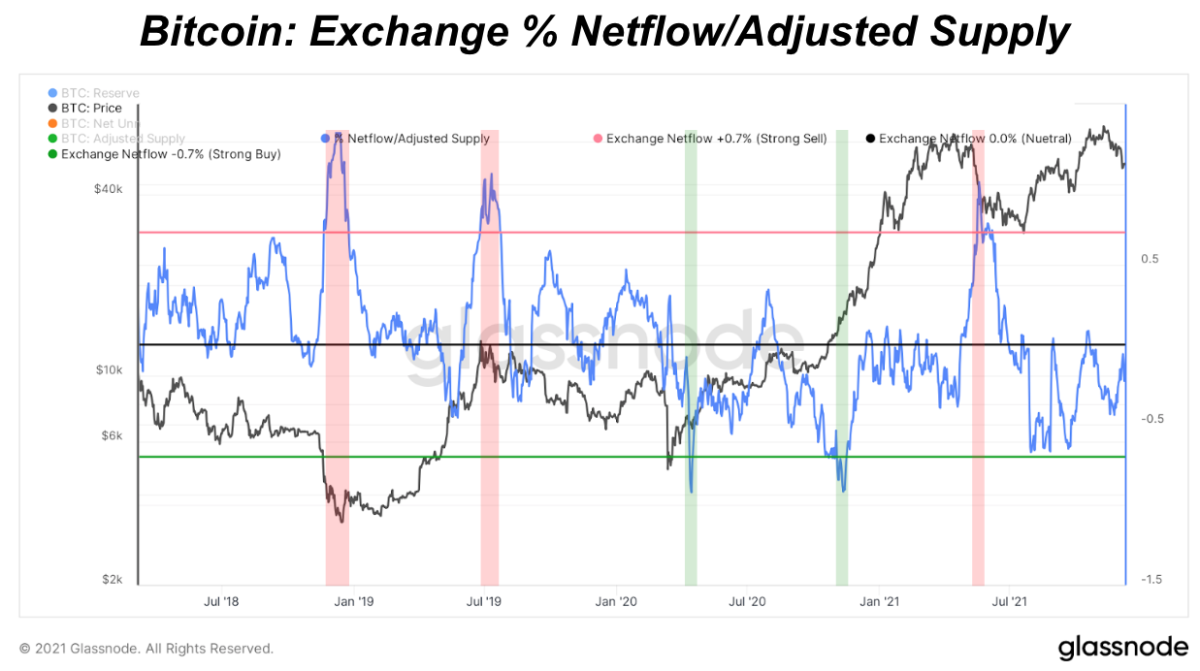

We can also take the 30-day moving average of exchange netflow and adjust it by adjusted supply (circulating supply adjusting for lost coins).

The green and red arbitrary thresholds are times when 0.7% of bitcoin’s adjusted supply were withdrawn or deposited on exchanges respectively.