Central banks globally are fighting the deleveraging of the largest debt bubble in modern history. With inflation recently hitting its highest levels in 30 years[1], many have called for more responsible policy decisions from central banks, to tame the inflation that’s now ravaging the everyday person.

However, every time central banks attempt to taper and remove artificial stimulus injections into markets, assets begin cratering.

Central banks globally are stuck between a rock and a hard place. Continuing to print and run enormous fiscal deficits will only accelerate the already out-of-control inflation. Meanwhile, every time they stop printing and attempt to raise rates, assets begin selling off precipitously.

Many believe central banks are simply out of options in trying to combat this economic conundrum. Or, do they have a nuclear plan hidden up their sleeves that they’re about to unleash, making the unprecedented 2020 balance sheet expansion look trivial in comparison?

Global Debt Crisis!

Before we look at central banks’ nuclear “solution,” we need to understand why they’d consider such a move and why deleveraging is simply not an option.

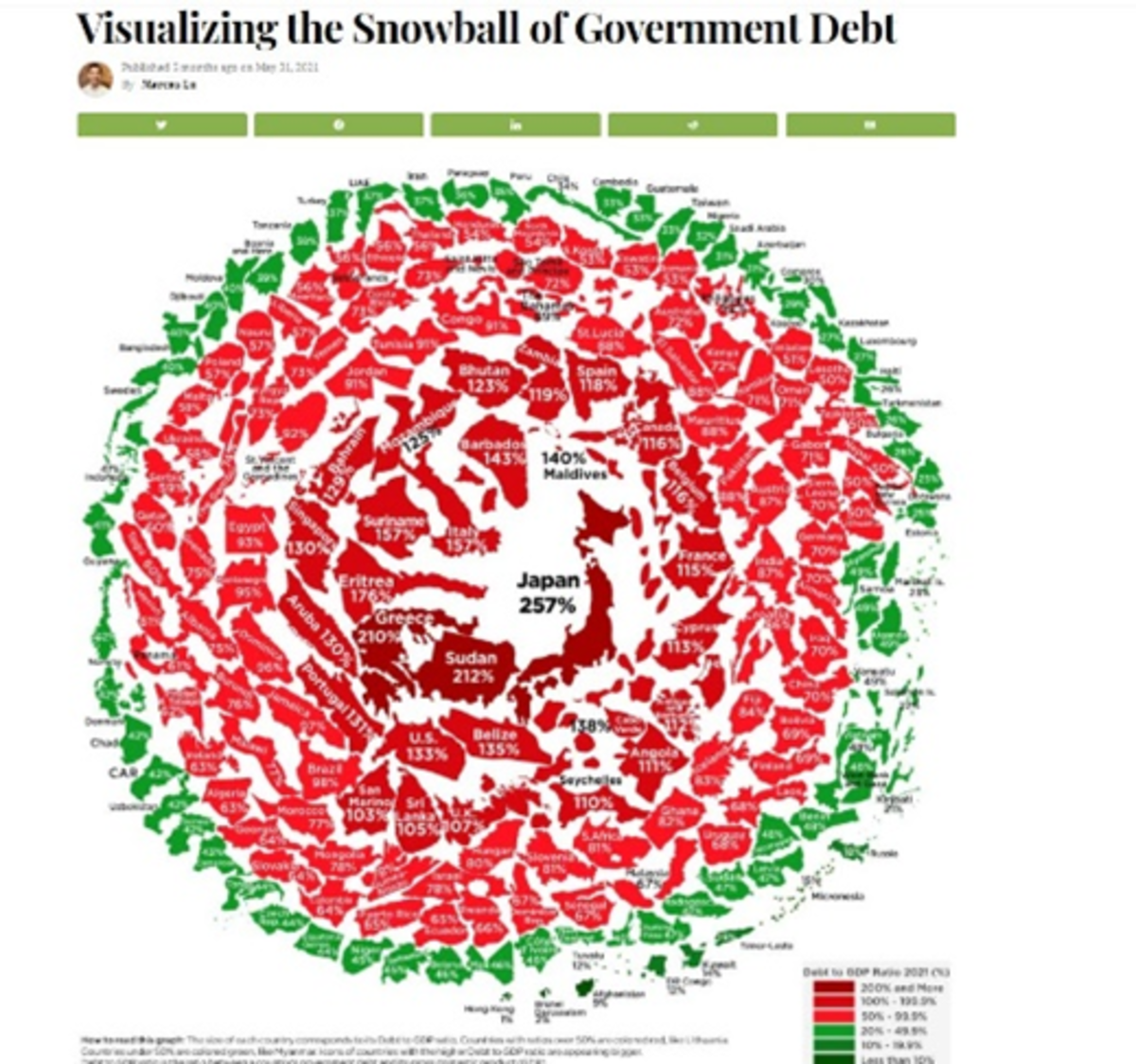

The world has never been more indebted than today in the 2020s, as central banks are trying to avoid a repeat of the mass deleveraging event of the 1930s. The 90% correction in the Dow Jones in 1929 led to a decade-long period of high unemployment, suffering and starvation. The decade in the 1930s is today known as the Great Depression.

At this stage of a long-term debt cycle, with interest rates at zero and debt levels unsustainably high across the globe, central banks’ are desperately hoping to avoid a repeat of the 1930s.

Hirschmann Capital released