Bitcoin has had its fair share of bear markets in the past. Let’s briefly recap the most significant ones and see what we can learn from them.

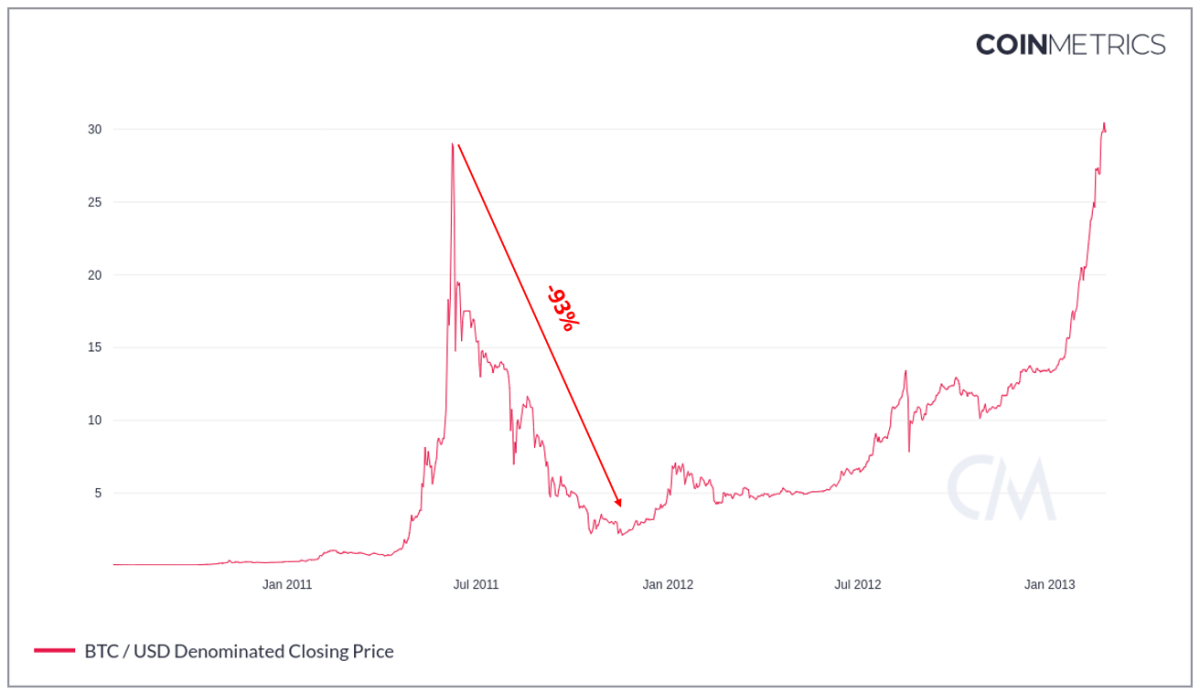

The 2011-2012 Bear Market

The bitcoin price fell from $29 on June 8, 2011 to $2.10 on November 18, 2011, followed by months of sideways action:

The most painful bear market happened before most of us were even aware that something like bitcoin existed. More than ten years ago, the price of bitcoin reached almost $30 on the then-popular Mt. Gox exchange, only to be followed by a “stairway to hell” pattern that would take the price to $2.10 in a several months’ time.

Bitcoin dumped 93%! But consider this: buying bitcoin even at the all-time high (ATH) price of $30 would still have been a steal from today’s perspective. Who wouldn’t want to stack some bitcoin at $30 dollars, right? Of course few back then could anticipate that in ten years, bitcoin would sit around $50,000; that’s why after that initial drop, it took more than a year for the price to recover and climb to new heights. The perception of what bitcoin actually is evolved over the decade as it went from a geeky experiment to darknet currency to an inflation hedge, and potentially the basis of the future global monetary system.

When the price breached the previous ATH in early 2013, it never dipped below that price level again.

The 2014-2016 Bear Market

Bitcoin’s price later tumbled from $1,135 on December 4, 2013 to $175 on January 14, 2015, followed by months of sideways action:

At the turn of 2013/2014, two major things happened: the Silk Road marketplace