Deep Dive

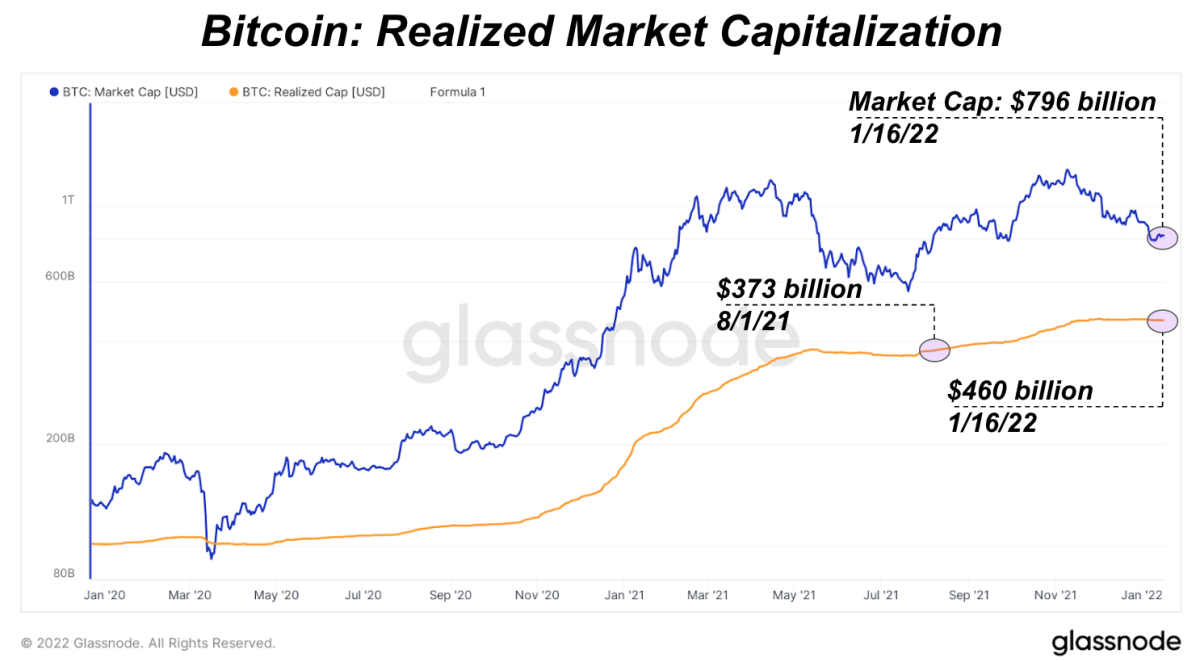

[1]The realized market capitalization of bitcoin, or aggregate price paid for every coin on the network, increased by $87 billion since last August.

-

Author:

-

Publish date:

The realized market capitalization of bitcoin, or aggregate price paid for every coin on the network, increased by $87 billion since last August.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now[3].

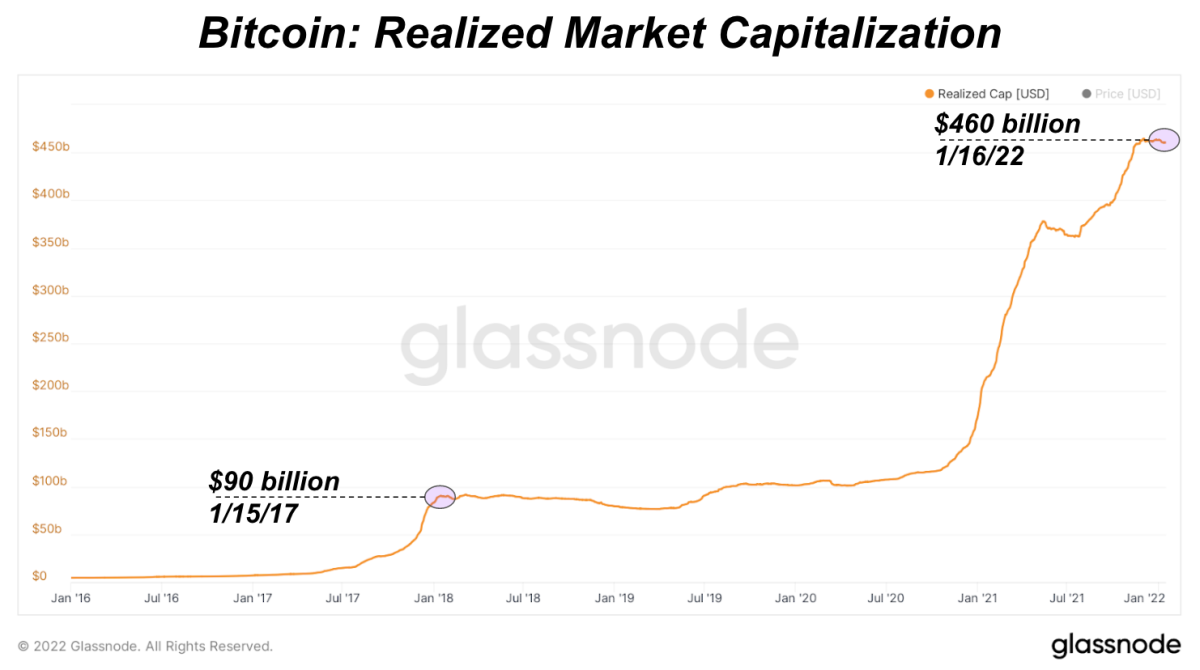

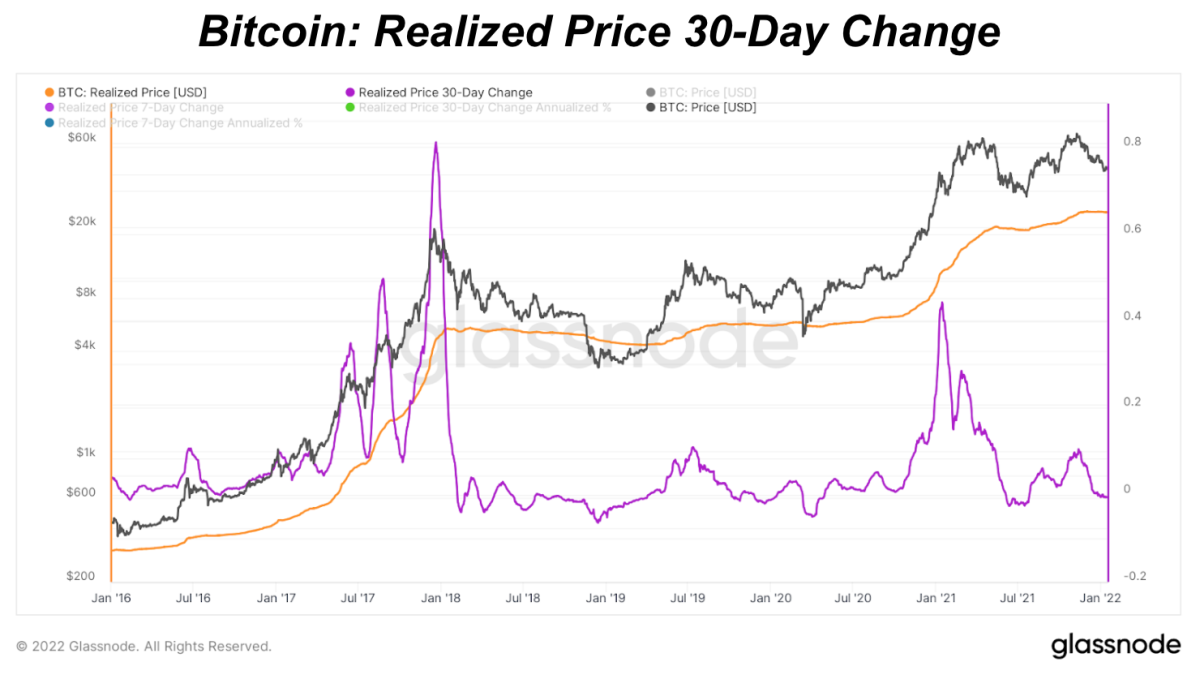

In recent weeks, much of our analysis has been focused on the consolidation period currently occurring in the bitcoin market, with a particular focus on realized price as an indicator of lackluster capital flow. As shown by the chart below, the realized market capitalization of bitcoin, which can otherwise be thought of as an aggregate price paid for every coin on the network, has increased by $87 billion since the beginning of August.

While significant in absolute terms, given that the realized market capitalization of bitcoin was a mere $90 billion at its peak following the 2017 bull market, in relative terms realized cap has not meaningfully increased since early fall of 2021.

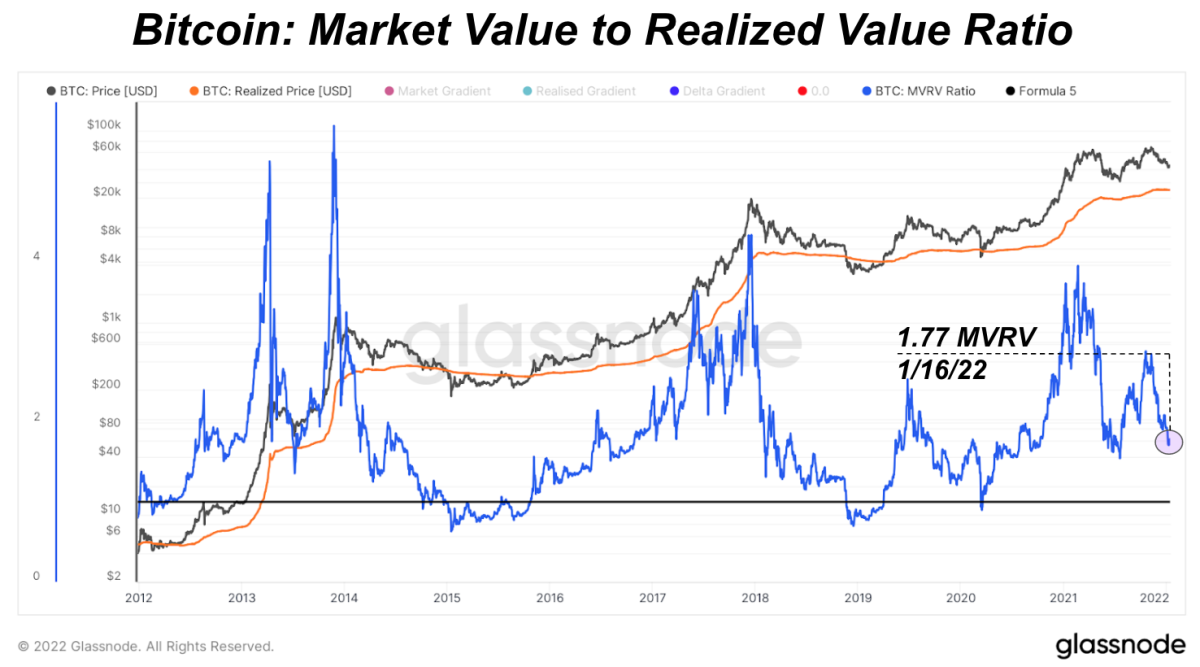

A look at the 30-day rate of change of realized price gives additional context to this dynamic.

To dig deeper into the dynamic of price and realized price, we can examine the Delta Gradient indicator. The metric gauges market momentum relative to capital inflows.

As per Glassnode,

“The momentum of a market can be considered by assessing the rate of change of price, or the verticality over some period. The simplest example is a parabolic advance, whereby the rate of price appreciation increases in