Given the jarring news overnight that Russia have invaded Ukraine, it feels a little trivial writing about finance this afternoon. I really hope the people of Ukraine will be OK and, on a personal level, I just can’t believe in 2022 that we are on the brink of war in Europe. It’s sad.

But in looking at financial markets, volatility has understandably spiked in the last 24 hours. In this piece, I want to focus on something I have found particularly interesting: Bitcoin’s price movement compared to other major asset classes. Because one of the most seductive narratives in crypto is that of the hedge theory:

• Bitcoin offers an effective inflation hedge, a method of avoiding fiat debasement (prominent in the recent climate of money printer goes brrrr).

• It is digital gold – accordingly, it improves risk-return characteristics of a portfolio containing stocks.

Specifically the latter point is one I want to address, in the context of the last 24 hours.

Market Fallout

So, Putin declares war. How did markets react?

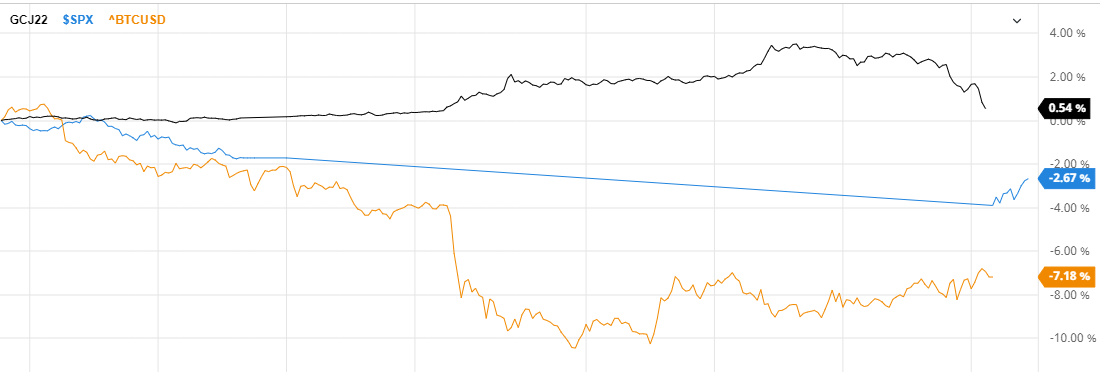

• Stocks: S&P 500 fell circa 2.8%, Europe’s Stoxx 600 share index dropped 3.5% and Nasdaq was close to 3% down. This is to be expected – no surprises here.

• Gold: The commodity hit a 17 month high, rising circa 1.5% and therefore making good on its hedge promise. Gold bugs rejoice, but nothing too out of the ordinary here either.

• Bitcoin: The self-proclaimed digital gold has talked itself up as a hedge for a while now. Well, we have our crisis and we have our stock market plunge – so time for Bitcoin to put its money where its mouth is. The result? A 7% nosedive.

Returns of Gold

Returns of Gold