The price of any asset is always impacted by a combination of factors. Unlike traditional financial assets, bitcoin has historically had its own set of factors affecting its price. Do things look any different now? Let's find out.

Basic Factors: Supply And Demand

Bitcoin’s price is heavily dependent on supply and demand fluctuations, just like other assets. However, contrary to measures of fiat money, bitcoin’s supply is always known and its hard cap is set at 21 million coins.

The demand for bitcoin always sits at the top of the cryptocurrency world’s agenda — that’s why adoption of BTC is so talked about. Higher demand will lead to an increase in its price, especially when institutional investors get involved.

For example, when companies and institutions began buying[1] and holding bitcoin in early 2021, its price rose significantly as demand outpaced the rate at which new coins were being placed on the market for sale, resulting in a decrease in the total available supply of the cryptocurrency.

Its price will drop, however, if there are more people who want to sell it.

Institutional Adoption

News influences investor perception about Bitcoin in a major way.

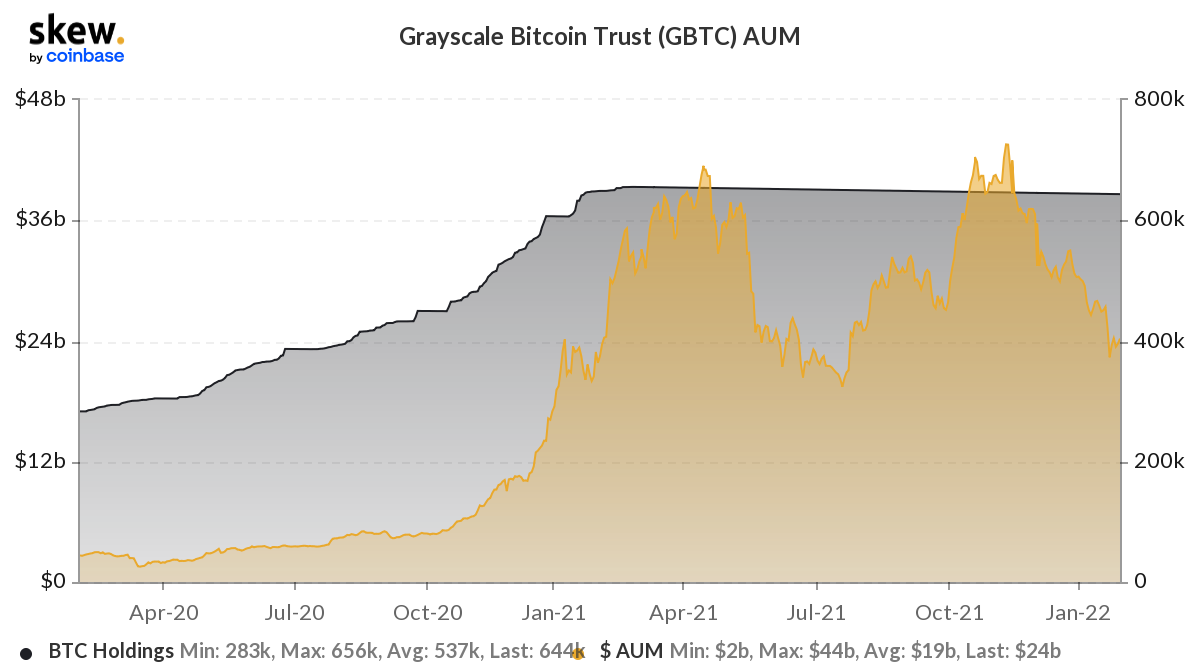

In spite of extreme volatility in bitcoin’s price, the year 2021 stands out for its unprecedented adoption by both institutions and corporations.

For example, Grayscale Bitcoin Trust had an average AUM of $31 billion and an average Bitcoin holding of 650K in 2021.

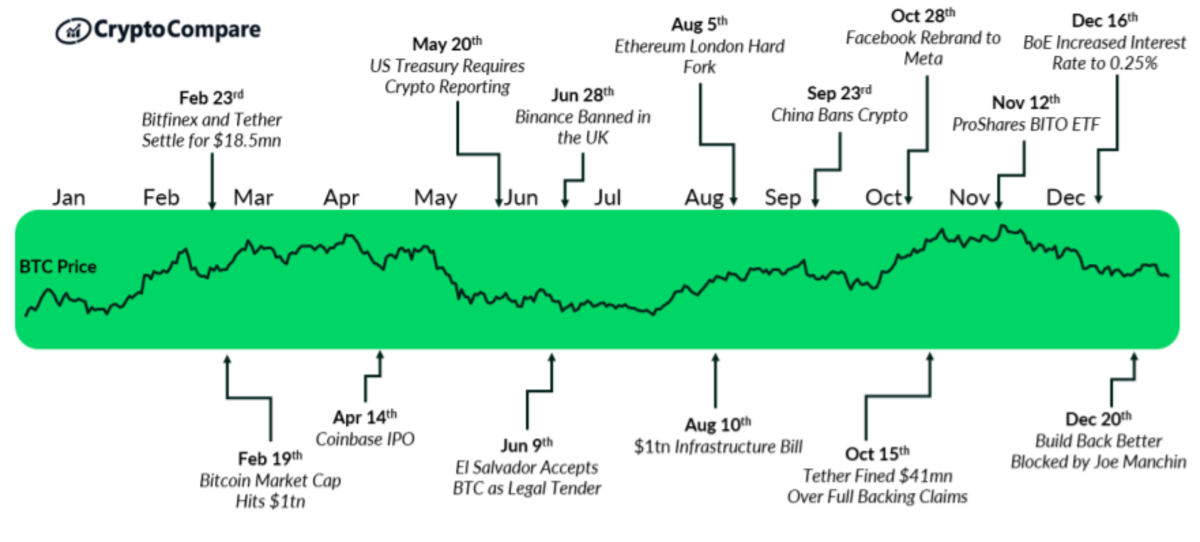

Crypto Regulation

Bitcoin’s price is also affected by regulatory developments. Changes in regulation can encourage or discourage investment in BTC or in its use, which in turn leads to an increase or decrease in its price.

Here's how the bitcoin price overlaid with regulatory events in 2021 looks: