As another week comes to a close in this eventful macroeconomic climate, let’s take a look at how the world of cryptocurrency looks, before we all take a breath over the weekend.

Key Points

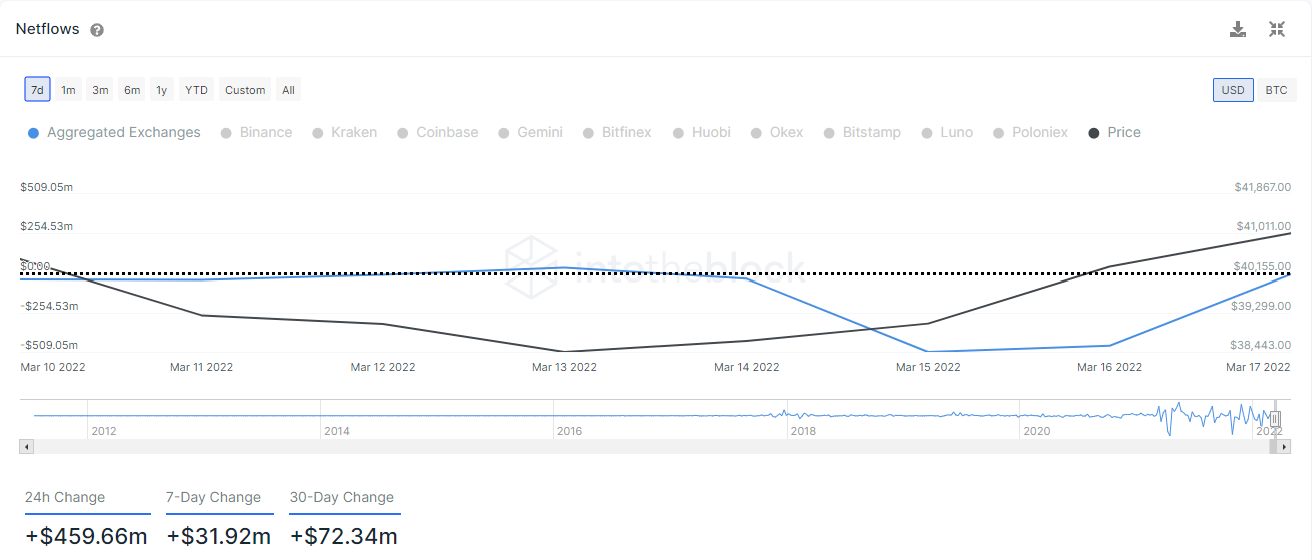

- Bitcoin net outflows from exchanges breach $1 billion for the week

- Tuesday sees highest daily outflows in ETH since October

- Moderate uptick in new and active addresses for Bitcoin

Bitcoin

Net Flows

Data via IntoTheBlock

Data via IntoTheBlock

A nice milestone for Bitcoin this week, as net outflows from exchanges breached the billion dollar mark, as displayed on above graph. One of the go-to indicators of sentiment, a net outflow from exchanges typically means accumulation, while a net inflow signals selling pressure.

Volatility

Price-wise, we “closed” last Friday at $39,200, while currently we sit at $40,700. Looking at volatility, the 30-day annualised standard deviation remained relatively stable at circa 63%. This is shown on the below graph, but if we want to translate these numbers to simple English, we can simply say that this week Bitcoin was … chill. As the world seems to be falling down around it, Bitcoin has been actually been quite well behaved. Who would have thought?

Data via IntoTheBlock

Data via IntoTheBlock

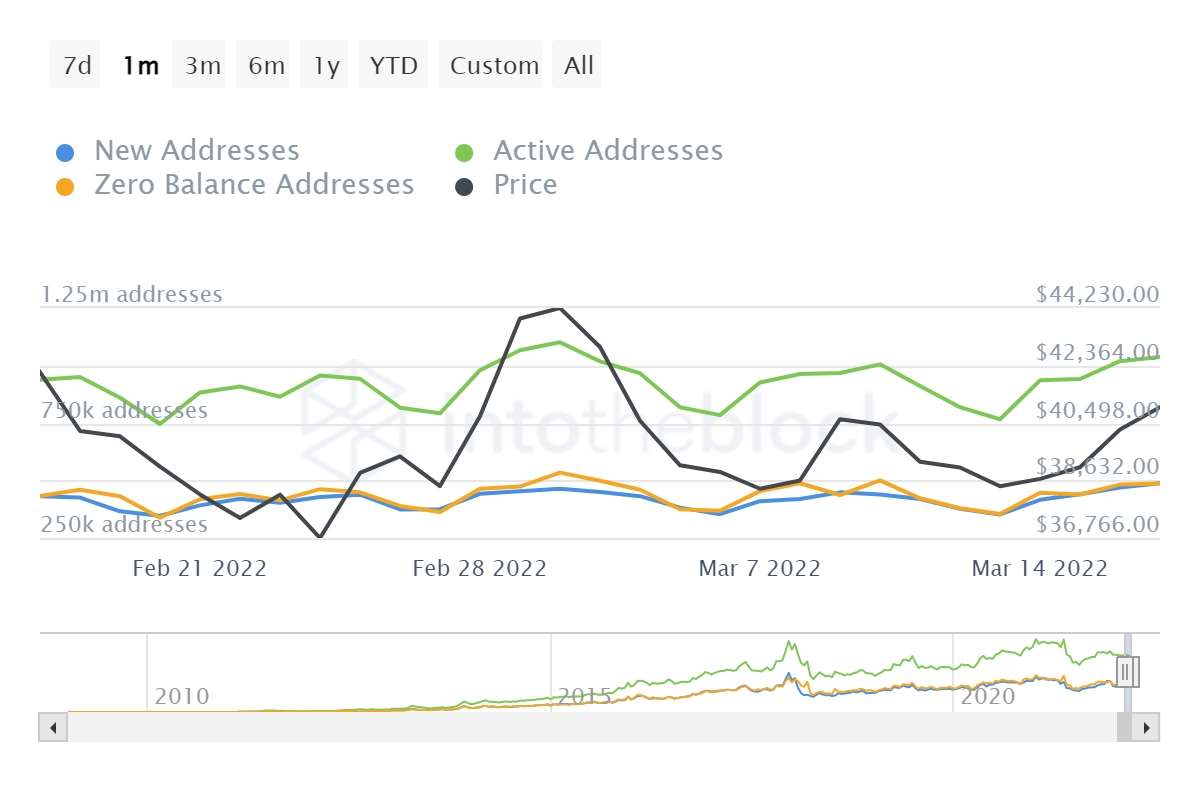

Addresses

Some moderate uptick here too, with an 11% increase in new addresses since last week. Active addresses were relatively stable (up 3%) and there was a fall of 2% in zero-balance addresses. All pointing, again, to a steady but unspectacular week for Bitcoin. If only all the weeks were like this – this must be what it feels like to hold stocks, right? Maybe next week we will get some more movement, helping to make this piece a little more entertaining!

Data via IntoTheBlock

Data via IntoTheBlock