- In collaboration with bitcoin-Lightning payment processing company Opennode, Arcane crypto published “The State of Lightning: Bitcoin As A Payment Network” for its second volume in Lightning Network research.

- Lightning has experienced exponential growth with companies like Cash App and the nation-state of El Salvador on-boarding millions of users in a short time. Services arising from this level of adoption drive channel and capacity growth, leaving plateaus in their wake.

- While nodes continue to increase as new users join the network, the more interesting statistics lie in the crevices of transaction volume and quantity.

Arcane[1], a leading cryptocurrency market analysis firm, partnered with Opennode[2], a Lightning Network payment processor, and recently published[3] “The State of Lightning: Bitcoin As A Payment Network.” This is the second volume of data released detailing adoption of Bitcoin’s layer two Lightning Network powered by Opennode. Bitcoin Magazine's previous coverage can be found here[4].

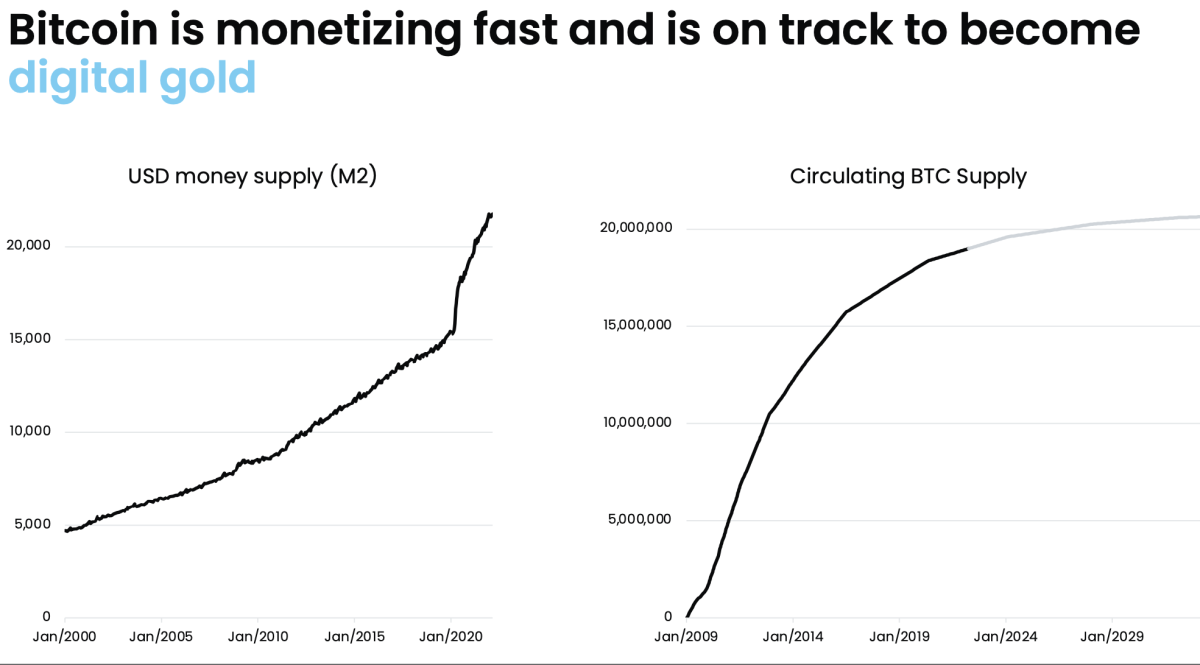

Arcane notates the divergence of the U.S dollar from a traditional characteristic of value, scarcity. The graph below hints towards a cautionary tale for the future of the U.S Dollar as rapid printing of the currency has unapologetically increased in supply. Bitcoin however, is reaching its programmatic inflation curve and aligns perfectly to the ideas of a digital form of gold.

Arcane notes that in order for Bitcoin to succeed, it needs to achieve both liquidity and scale. Arcane draws a parallel between email and money. Email was able to revolutionize a communications network over the internet and Bitcoin has the potential to revolutionize payments transactions across