The following article is an opinion piece and is not intended to be financial advice.

“Ask yourself: Is bitcoin going up more than 3% every year? Then it is a mistake not to maximize your exposure at the current rate of inflation. Any loan you can roll forward for a reasonable amount of time is good. A loan with a 10- to 15-year mortgage against your property is a no-brainer.” — Michael Saylor

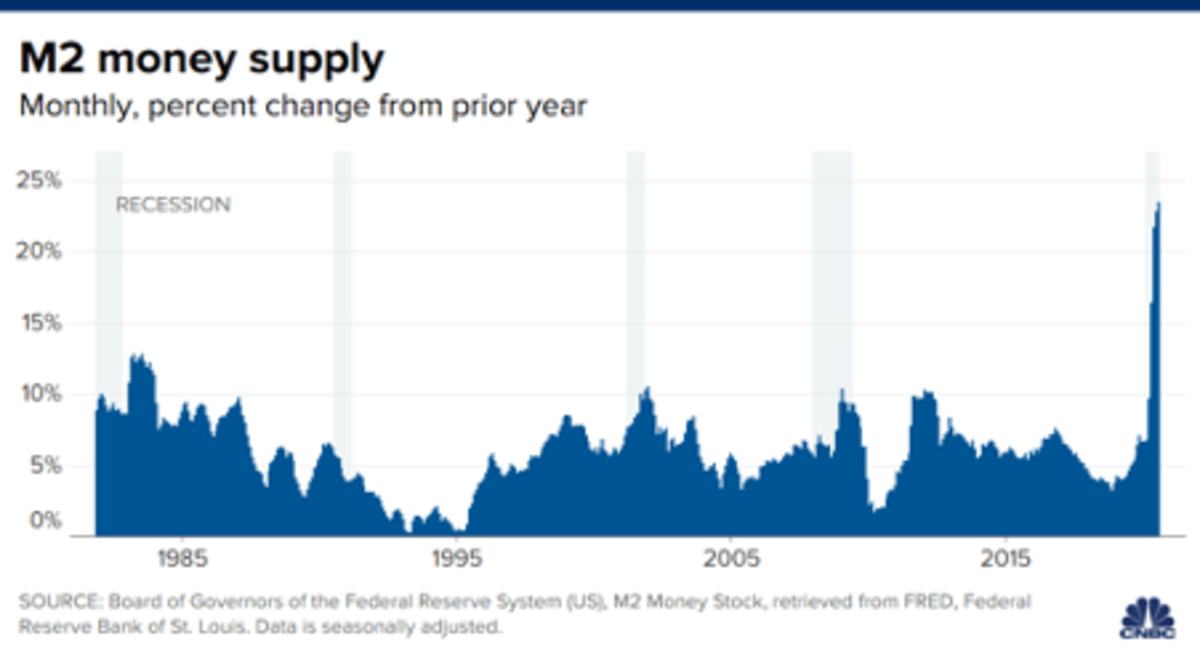

Bitcoin is the best insurance against inflation. The continuous issuance of money by central banks has debased fiat currencies, destroying their purchasing power. More than one in five dollars was created in 2020 and 2021[1].

Data from the Federal Reserve shows that a broad measure of the stock of dollars, known as M2, rose from $15.4 trillion[2] at the start of 2020 to $21.18 trillion in December 2021. M2 is a measure of the money supply that includes cash, checking and saving deposits and easily convertible near money like treasury bills and money market funds. The increase of $5.78 trillion equates to 37.53% of the total supply of dollars.

Bitcoin, which is limited in supply, increases in price as market participants are looking for a good store of value to protect their money against inflation and government confiscation. This was illustrated by the recent spike in the ruble/bitcoin trading pair with volume increasing as Russians looked to circumvent sanctions imposed by the international community because of the Russian invasion of Ukraine on Thursday, February 24, 2022.

Bitcoin has outperformed most assets in the legacy system over the past decade and will most likely continue to do so. Bitcoin exhibits the qualities of sound money — scarcity, durability, divisibility, portability and fungibility — like no other monetary asset