Bitcoin Magazine Pro

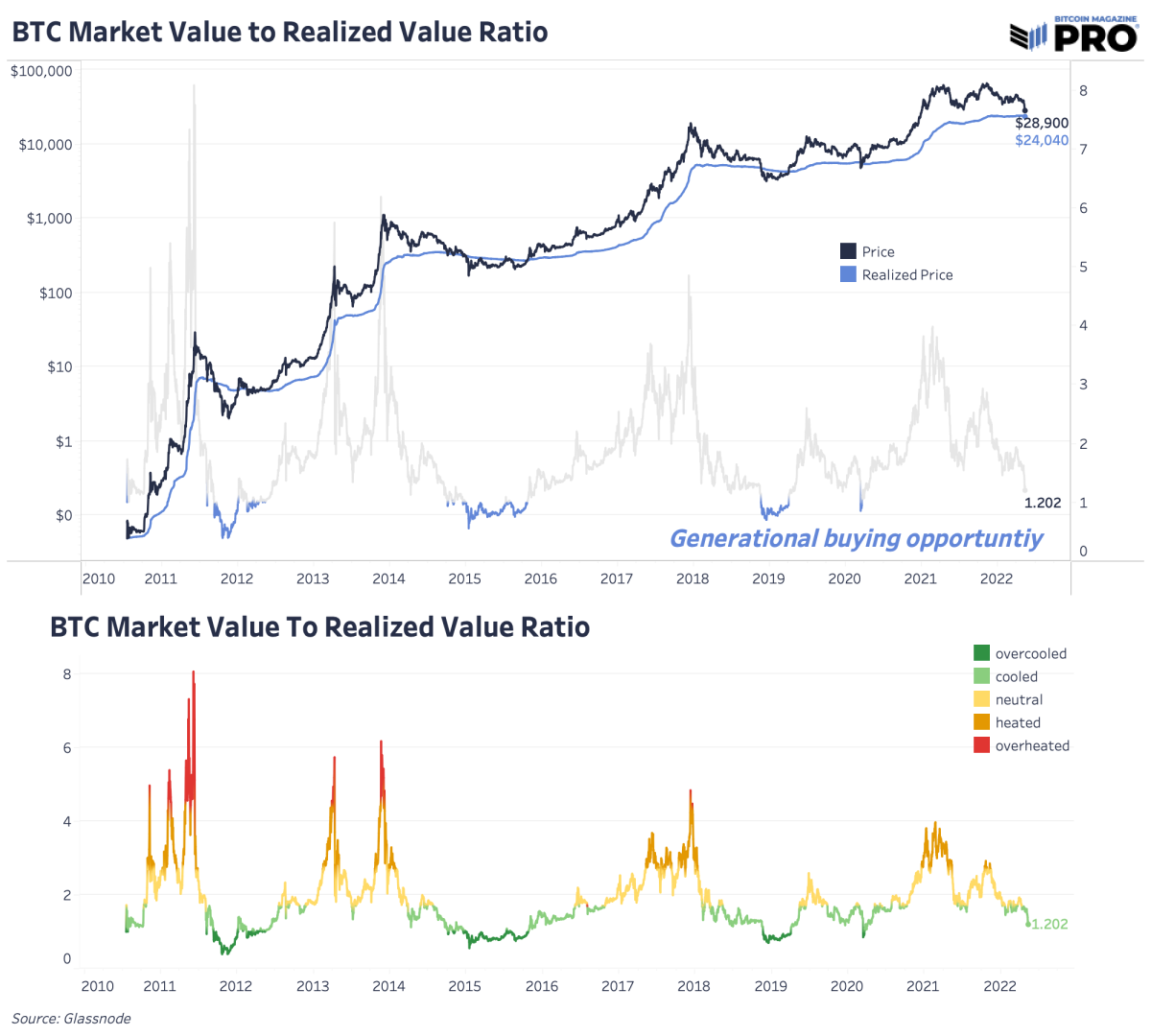

[1]The realized price of bitcoin is around $24,000 and a lack of long-term holder capitulation means there is potentially more downside to come.

The realized price of bitcoin is around $24,000 and a lack of long-term holder capitulation means there is potentially more downside to come.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now[2].

In a previous issue, we highlighted that based on the level of realized losses, unrealized losses and capitulation trends in the past, we had yet to see a bear case capitulation play out:

“The key on-chain price areas to watch are still those that make up the cost basis. Currently the market’s realized price is around $24,000 while long-term holders realized price is around $17,000. As short-term holders realize losses, short-term holders realized price has dropped to around $48,000. If we’re to get the long-term holder market capitulation we’ve seen in the past, there’s potentially more downside to come.”

Today, as bitcoin hovers above a critical $28,000 price and technical level, we’ve yet to see major capitulation play out in the broader equities market as bitcoin reaches its all-time highest equity market correlations. The bitcoin bottom will likely come with a broader risk-on asset bottom and will depend on the reversal of tightening financial conditions and fleeting liquidity.

Capitulation-like sell-offs across broader cryptocurrencies, in BTC terms, played out over the last few days with Luna losing 98.76%. High-beta investments relative to bitcoin are getting