Bitcoin Magazine Pro

[1]The U.S. dollar accounts for nearly 100% of stablecoin value and a window of opportunity for policymakers has emerged with the collapse of UST.

The U.S. dollar accounts for nearly 100% of stablecoin value and a window of opportunity for policymakers has emerged with the collapse of UST.

In this excerpt from Bitcoin Magazine Pro, we will take a more in-depth look at the redemption mechanism of USDT, and cover why the concerns about the stablecoin and the apparent risks it presents to the bitcoin/cryptocurrency ecosystem.

Before digging in, it should be said that the advent of bitcoin on a long enough timeframe obfuscates the need for a “stablecoin,” which is really just a blockchain-based IOU held by a counterparty. A digital bearer asset that is completely stable on the protocol level and from an issuance and absolute supply perspective that can be held with no counterparty risk is the innovation. With that being said, the natural demand for dollars in the “crypto-economy” does make sense given the dollar’s incumbent status as the world reserve currency.

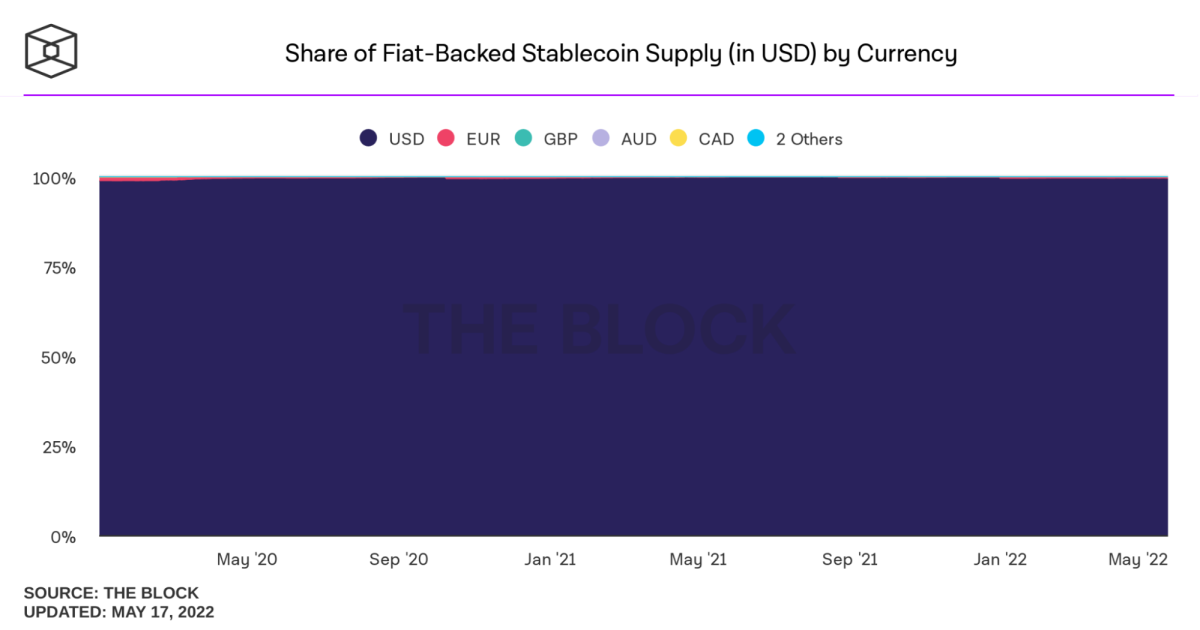

With today’s release and focus on stablecoins, as well as the recent collapse of UST, an interesting window of opportunity for policymakers has emerged to provide guidance and clarity to stablecoin issuers, which would result in a rising demand for monetizing U.S. Treasury debt. After all, in the cryptocurrency ecosystem, USD stablecoins account for nearly 100% of stablecoin value. Given the dollar's role as the world reserve currency today, this makes intuitive sense.

The U.S. dollar accounts for nearly 100% of stablecoin value.

The main takeaway from the rapid growth of stablecoins over the past two years is that despite the emergence of a digital monetary bearer asset with a fixed supply (bitcoin), there still is demand for