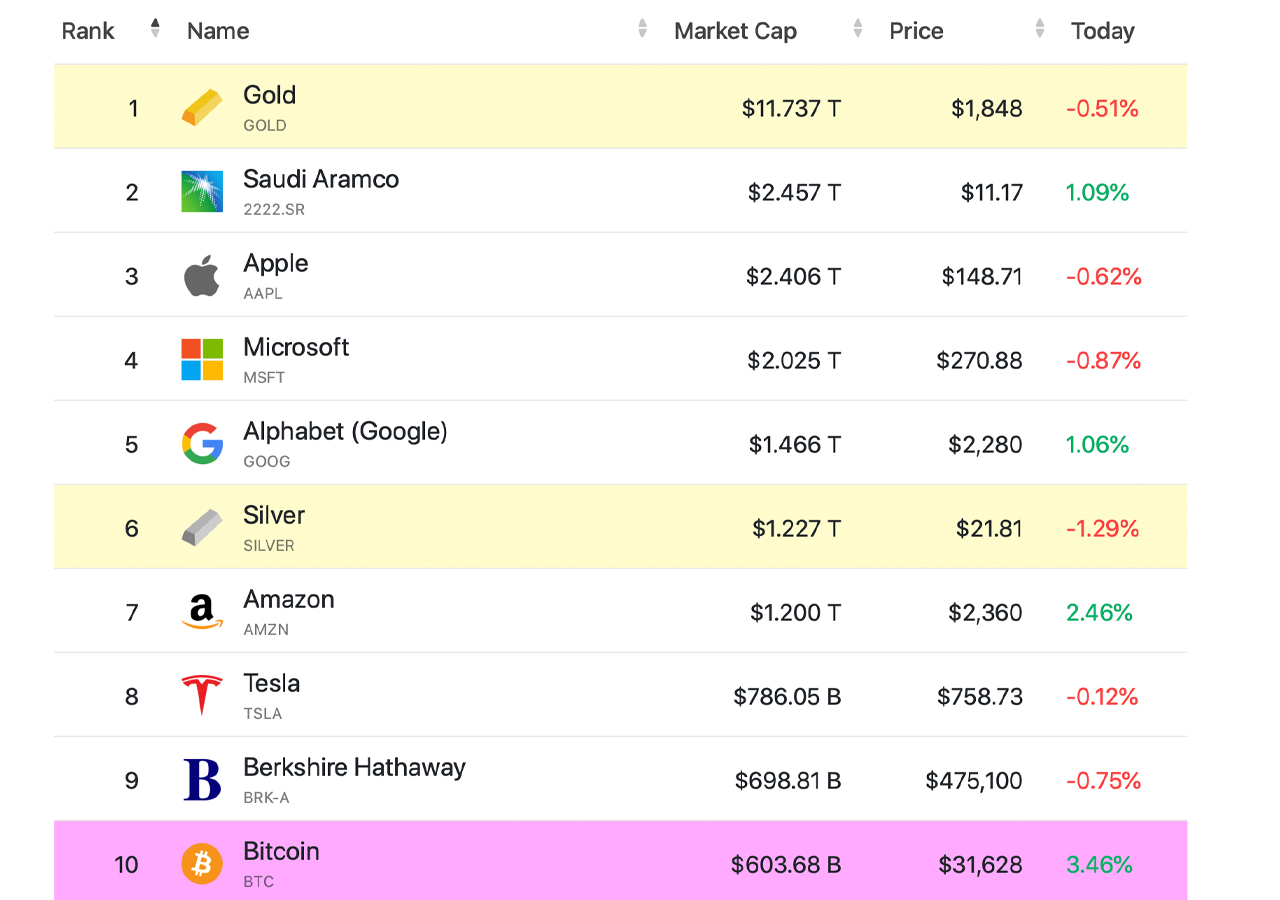

While bitcoin has lost more than 16% in value against the U.S. dollar during the past 30 days, the cryptocurrency’s market capitalization is still the world’s tenth-largest asset by market valuation. With $603 billion in market value, bitcoin is above Meta’s (formally Facebook) capitalization and just below Berkshire Hathaway’s overall valuation.

Despite Losing Over 16% in a Month, Bitcoin Is Still the 10th Most Valuable Asset Worldwide

The leading crypto asset bitcoin (BTC) has had a rough few weeks in terms of market prices dropping. A month ago today, BTC was 16.4% higher in USD value as the recent stock market carnage and the Terra LUNA and UST fiasco contributed to bitcoin’s losses. However, in terms of market dominance, BTC’s market capitalization among more than 13,000 cryptocurrencies is now over 44% of the $1.36 trillion crypto economy.

While BTC is the number one leading crypto asset today in terms of market valuation, the crypto asset’s market cap makes it the tenth-largest in terms of all the major market capitalizations stemming from the likes of companies like Apple and Amazon, alongside precious metals like gold and silver.

Today, gold is the largest market capitalization among the 6,265 commodities and companies that make up $86.516 trillion in USD value. One ounce of fine gold today is exchanging hands for $1,848 per unit and it has an overall valuation of $11.737 trillion. Companiesmarketcap.com metrics currently show bitcoin’s $603 billion market cap equates to 5.13% of gold’s overall market capitalization.

The second-largest asset is Saudi Aramco, which is worth $2.457 trillion and it eclipses the entire $1.36 trillion crypto economy. The third-largest global asset in terms of commodities and company shares is Apple with $2.406 trillion. While bitcoin