Jesse Colzani is a regulatory specialist and Bitcoin researcher.

When asked whether the Bitcoin network can be regulated or not, people tend to answer in a binary way. On one side, there are those who say that everything can be regulated. On the other, there are those who believe that Bitcoin has already irreversibly separated money from the state. This article is an attempt to better understand what Bitcoin regulation depends on and what are the tools that regulators can reasonably use to limit its adoption.

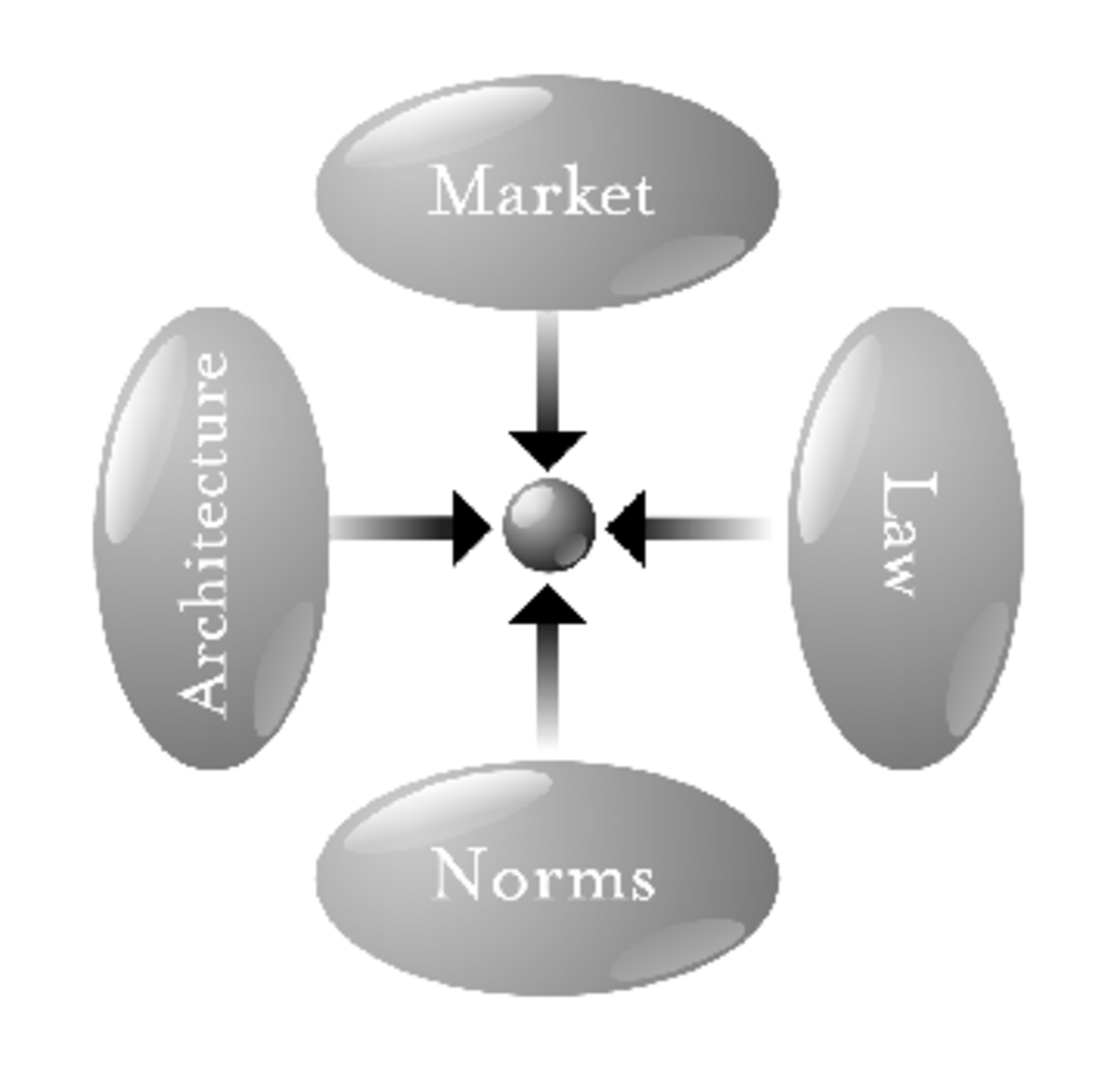

For the purpose of this article, regulation is considered as state-mandated legal restrictions. But laws are not the only forces shaping society. In what is often referred to as the “pathetic dot theory[1],” Professor Lawrence Lessig identifies three other forces that constrain the action of an individual.

- Markets regulate through the device of price and cost-opportunity.

- Social norms represent an intricate set of standards of behavior that are widely accepted within a community (like tipping a server in a restaurant).

- Architecture includes geographical, technological and biological barriers to human behavior (like laws of physics preventing us from levitating or a web app preventing us from accessing an online service).

Each force can — intentionally or not — influence other ones. Laws can limit deforestation (architecture), social norms can shape markets, and weather (architecture) can affect agricultural production and food prices.

Forces can have an influence on other forces

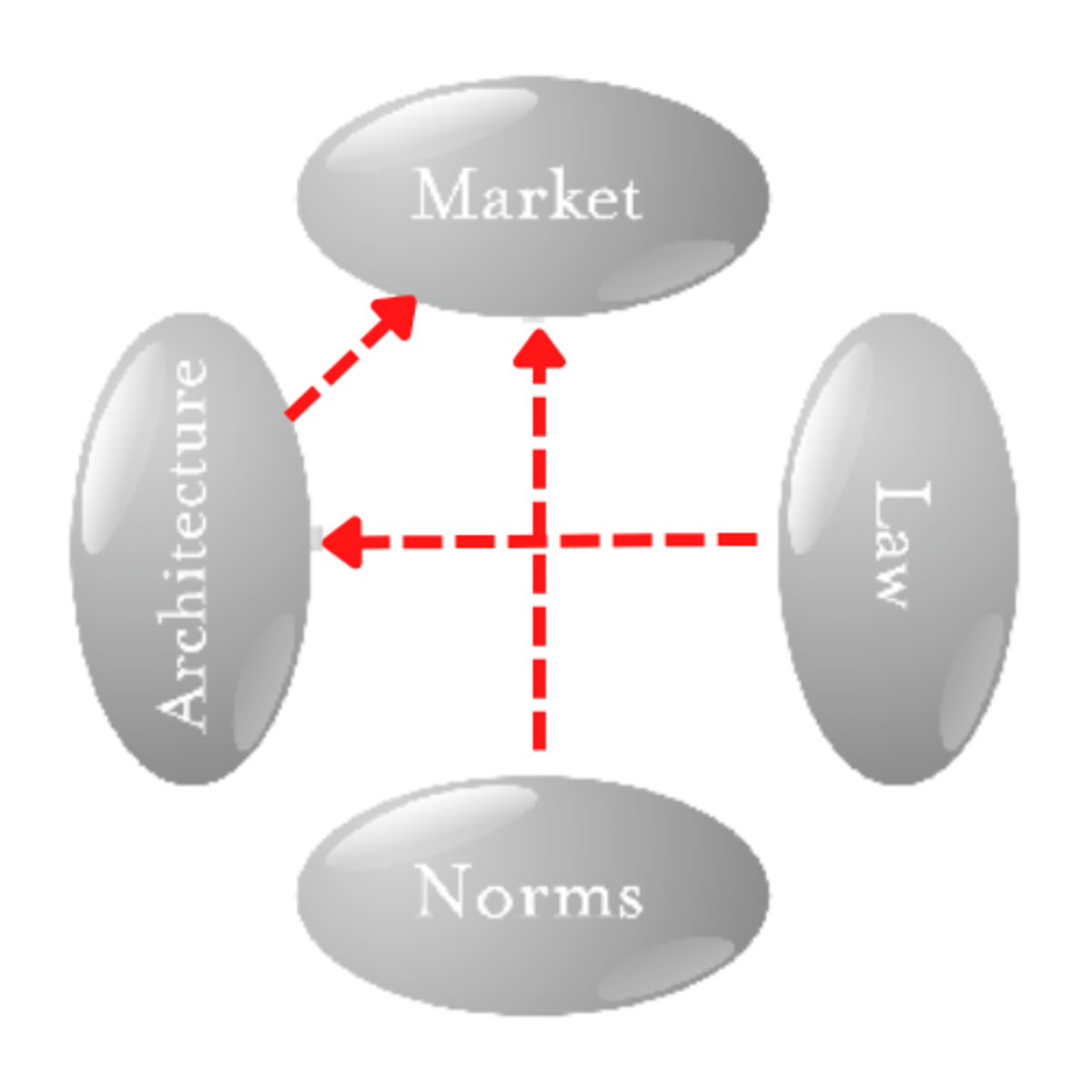

When a law cannot directly target individuals, lawmakers look to regulate other forces. This happens when the government causes the price of cigarettes to increase (market), when it prohibits the use of specific words on TV to influence citizens’ behavior (social norms) or when it builds concrete barriers to create pedestrian zones (architecture).

Law can impact markets, architecture and social norms

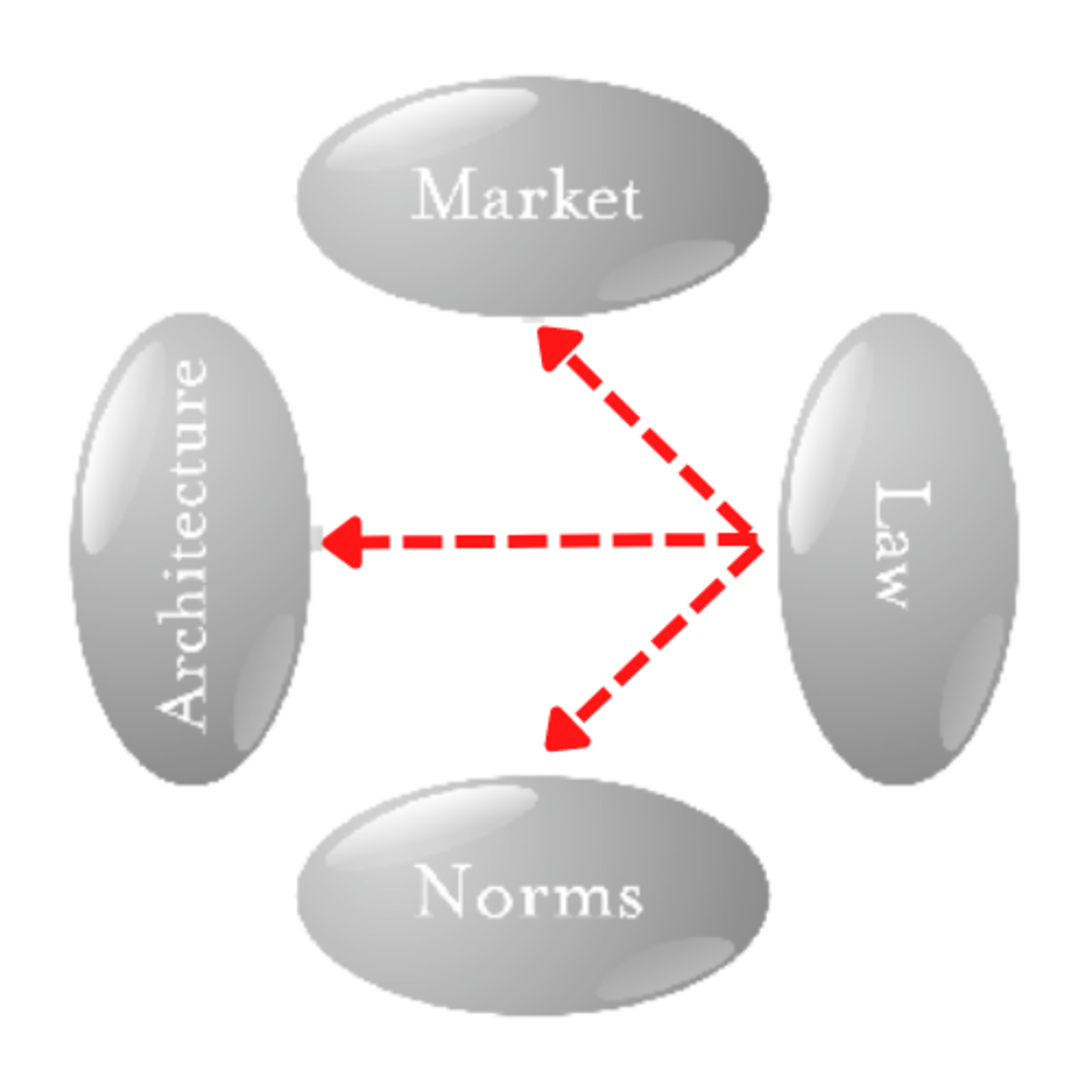

But can