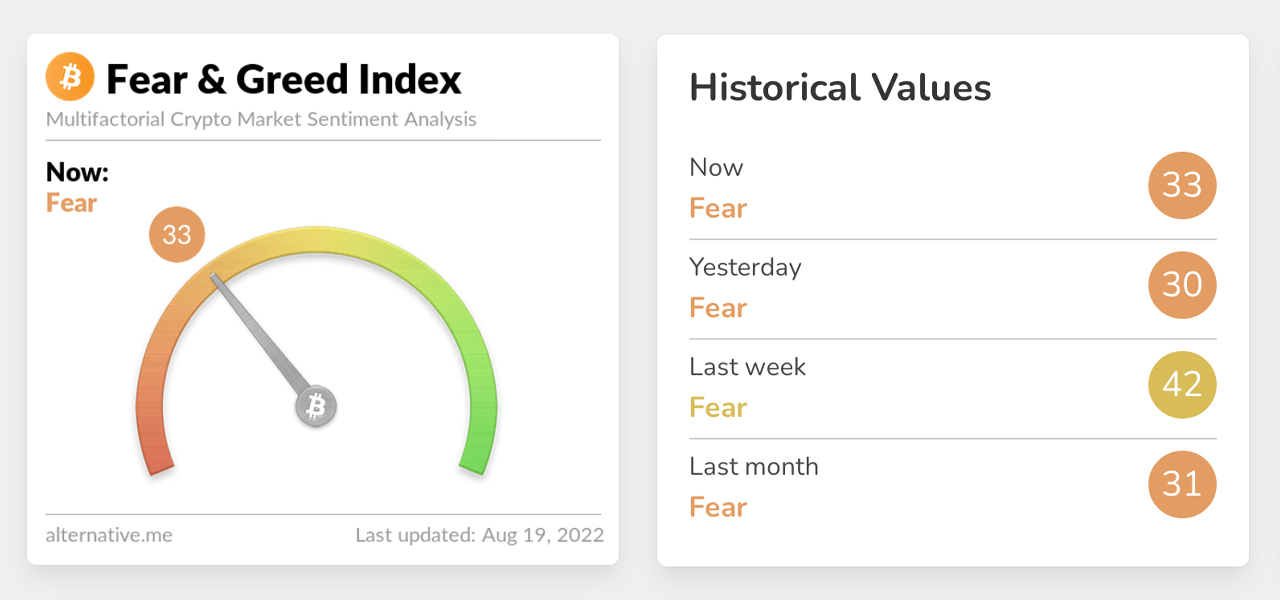

After the Crypto Fear and Greed Index (CFGI) dropped to significant lows and pointed to “extreme fear” in crypto markets at the end of May, and throughout most of June, today the CFGI rating is still in the “fear” zone, but it has seen an improvement. On June 19, the CFGI rating tapped a low score of 6 which means “extreme fear,” and 61 days or two months later, the CFGI rating now shows a score of 33 or “fear.”

CFGI Ranking Score Shows Crypto Winter Continues to Keep Investor Sentiment in the ‘Fear’ Zone

While the crypto economy has jumped back above the $1 trillion range, prices have started to drop again after the last rally. Following the Terra blockchain implosion, the crypto economy lost significant value and extreme fear shook the community into June as well. The Crypto Fear and Greed Index (CFGI) hosted on alternative.me dropped severely at the time, and on May 31, 2022, Bitcoin.com News reported the CFGI ranking score was 16 out of 100 or “extreme fear.”

Every day the CFGI ranking score analyzes “emotions and sentiments from different sources and crunch them into one simple number.” Alternative.me indicates that the value of 0 means “Extreme Fear” while a value of 100 represents “Extreme Greed.” The website adds:

The crypto market [behavior] is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction [to] seeing red numbers — There are two simple assumptions: 1) Extreme fear can be a sign that investors are too worried. That could be a buying opportunity. 2) When Investors are getting too greedy, that means the market is due for a correction.