Popular US cryptocurrency exchange Coinbase announced today the launch of its first ever index fund. Global Digital Asset Exchange (GDAX), which is owned by the San Francisco-based retail exchange, will provide to its accredited investors the option of buying the lot, all assets, weighted, into one financial product.

Also read: Québec Premier: We’re Not Really Interested in Bitcoin Mining

Coinbase Launches Index Fund

Bitcoin? Bitcoin cash? Ethereum? Litecoin? Why not all four! “We’re seeing strong demand from our customers and the market generally for a passive investment management product…but we’re finally seeing demand so that’s why we’re just launching now,” Coinbase’s Reuben Bramanathan explained to Reuters.

“We’re excited to announce Coinbase Index Fund,” the company announced. The fund “will give investors exposure to all digital assets listed on Coinbase’s exchange, GDAX, weighted by market capitalization. If a new asset is listed on the exchange, it will be automatically added to the fund.”

GDAX is Coinbase’s professionals-geared exchange, allowing for more traditional stock-like choices such as market, limit, stop, and margin orders. Coinbase proper, on the other hand, serves more than 13 million retail customers who’ve often claimed it to have been their first foray into crypto, buying and selling. Currently four digital assets are listed and paired, Bitcoin core, Ethereum, Bitcoin cash, and Litecoin. It remains the biggest crypto company on the globe, and is valued at over one and half billion dollars.

“We are seeing new investors coming to the market because they see an asset that is not correlated and outperforms, but they don’t know which ones to buy,” Mr. Bramanathan told Business Insider.

A Long Tradition on Wall Street

Index funds were popularized for Wall Street in the 1970s by John C. Bogle, founder of the veritable Vanguard Fund. Theories abound about the efficacy of fund managers and their ability to at least match broader markets and beat inflation. Minus fees and the perverse incentive to jump in and out of positions, index funds would be considered a conservative investment bet. Buy a weighted percentage of the entire class, across classes, whatever, and sit back and hope for the long-term best. Poorer performers might be mitigated by higher, the theory went, and though an investor would not see the massive booms she would also not suffer from hellish busts.

“Index funds,” the company continues, “have changed the way that many people think about investing. By providing diversified exposure to a broad range of assets, index funds enable investors to track the performance of an entire asset class, rather than having to select individual assets. We’re excited to give our customers the ability to invest in the potential of blockchain-based digital assets as a whole.”

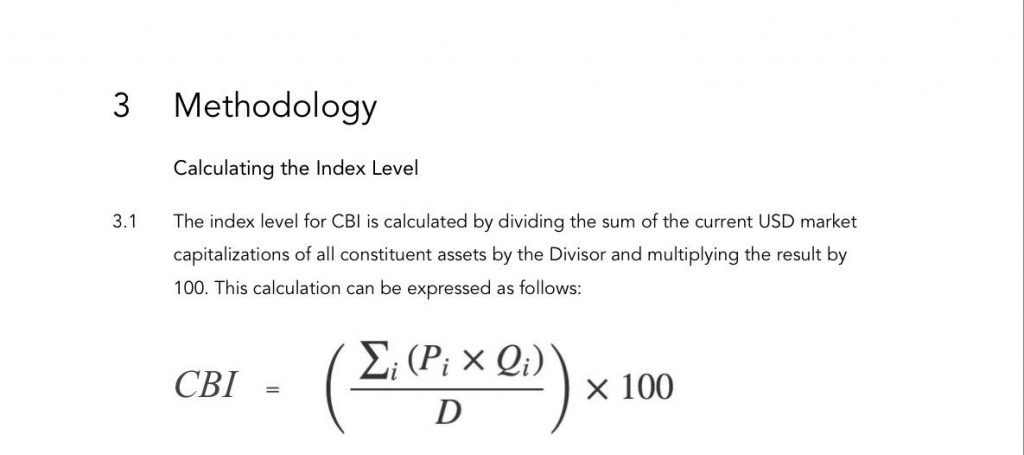

Coinbase Index (CBI) reportedly weights by market capitalization Bitcoin core at 62%, Ethereum 27%, Bitcoin Cash 7%, and Litecoin 4%. It’s possible to get a rough sense of its