Over the past few months, the Chicago Board of Exchange (Cboe) and the Chicago Mercantile Exchange (CME Group) have been selling bitcoin-based futures products. Predictions have been dull as most forecasts are around the $9-9.4K USD range for bitcoin derivatives using both firms’ futures data. On the other hand, crypto-derivatives trade volumes have been increasing.

Also Read: Nasdaq-Listed Marathon Begins Bitcoin Mining Operations, Stock Up 32%

Bitcoin Futures See an Increase in Volume But Crypto-Derivatives Markets Have Been Lackluster

Bitcoin futures markets have seen some monotonous forecasts because they really haven’t been much different than spot markets. This week marks the March expiry date for Cboe’s bitcoin derivatives on Wednesday, and products are trading between $9,490 – 8,820. CME’s contracts will expire this month as well and forecasts there are also around $9,000 – 8,800.

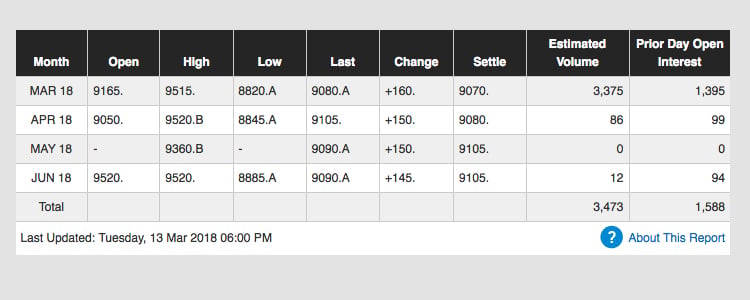

CME contracts at the end of the day Chicago time, March 13.

CME contracts at the end of the day Chicago time, March 13.

Cboe contracts are seeing the most volume for March and the following three months later. CME Group’s numbers have been relatively consistent at 1,000 per day, but the month of May has zero volume at the time of publication. The sentiment across both derivatives markets show that currently, all the past hype about bitcoin futures markets affecting spot markets turned out to be incredibly lackluster.

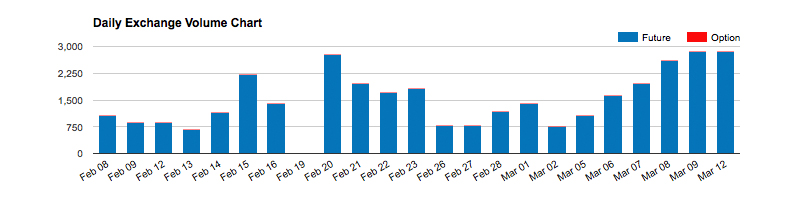

CME bitcoin futures trade volume.

CME bitcoin futures trade volume.

However, Cboe’s contracts have seen significant volume especially this month as the March expiry will close above 10,978 for the daily volume. April has 1 has a 24-hour volume of 517, May – 90, and June – 88. The projections for Cboe’s futures in June show an increase of 330 percent and a price at $9,250 per XBT. CME Group’s products are not as popular but still have been consistent 1,000+ per day. Right now the firm’s March expiry is 3,288, April is 78, May – 0, and June shows only 10. The last month’s expiry for CME Group’s bitcoin futures shows an increase of 410 percent and a price around $9,370.

BTC/USD futures and spot markets have been almost identical.

BTC/USD futures and spot markets have been almost identical.

Does a Market Operating 24-7 Mix With Traditional Futures Trading?

Skeptics believe futures traders and traditional exchanges cannot grasp the wild fluctuations that take place in a market that never stops. Even though bitcoin futures products haven’t produced the fervent action many speculators thought, Terry Duffy, the chief executive of CME is not worried. Speaking in a recent earnings call, Duffy said the bitcoin derivatives market maturation would be lead-footed.

“It’s [Bitcoin futures markets] going to be a slow grower, which is fine,” Duffy explains.

Further CME Group’s margin investors must pay 40 percent on contracts (Cboe 44% of the BTC/USD price). This means most margins are single digits, and some people have suggested reducing the margin. This kind of development could introduce risk, and according to Duffy that type of strategic move is “the last thing” he would want