Talking Points:

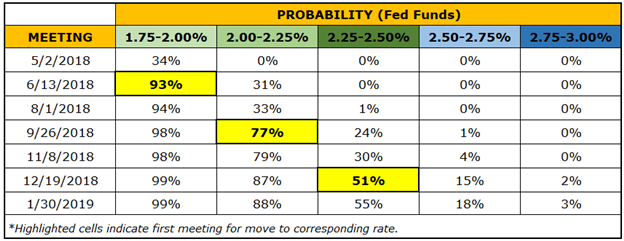

- Fed funds futures pricing in 25-bps rate hikes in June (93% implied probability), September (77%), and December (51%). - Rise in US Treasury yields and bump in rate hike expectations coincides with US Dollar (via DXY[1] Index) breaking downtrend from March, April, November, and December 2017 highs. - See the full DailyFX Webinar Calendar[2] for upcoming strategy sessions. Looking to learn more about how central banks impact FX markets? Check out the DailyFX Trading Guides[3]. The US Dollar has continued its tear this week, on pace for its seventh daily gain over the past eight days. The catalysts have been twofold: a steady push higher in rate hike expectations by the Federal Reserve in 2018; and a rise in US Treasury yields across the curve. To the first point, Fed funds futures are now pricing in 25-bps rate hikes in June (93% implied probability), September (77%), and December (51%). While a December rate hike is the least certain of the three, ongoing acceleration in inflation figures to keep the Fed on a path of gradually raising rates at meeting that coincide with the release of new Summary of Economic Projections. Table 1: Fed Rate Hike Expectations (April 26, 2018) The rise in inflation over the past few months may finally have filtered into the US Treasury market, where yields have started to climb higher once again. Of note, the US 2-year note yield is now at the same level the 10-year note yield was back in October 2017; while the 10-year note yield has hit its highest level since January 2014. But this is not to

The rise in inflation over the past few months may finally have filtered into the US Treasury market, where yields have started to climb higher once again. Of note, the US 2-year note yield is now at the same level the 10-year note yield was back in October 2017; while the 10-year note yield has hit its highest level since January 2014. But this is not to