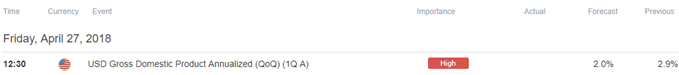

- Advanced 1Q U.S. Gross Domestic Product (GDP) to Show Growth Rate Slowing to Annualized 2.0% from 2.9%. Core Personal Consumption Expenditure (PCE) to Climb to 2.6% from 1.9%.

- EUR/USD[1] Clears March-Low (1.2155) as Bearish Sequence Unfolds. Relative Strength Index (RSI) Slips Towards Overbought Territory.

Trading the News: U.S. Gross Domestic Product (GDP)

Updates to the U.S. Gross Domestic Product (GDP) report may curb the recent weakness in EUR/USD as the growth rate is anticipated to slow to an annualized 2.0% from 2.9%.

Bear in mind, market participants may put greater emphasis on the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, as the reading is projected to increase 2.6% during the first three-months of 2018, which would mark the fastest pace of growth since 2007. Signs of heightening price pressures may ultimately trigger a bullish reaction in the U.S. dollar[2] as it puts pressure on the Federal Open Market Committee[3] (FOMC) to extend the hiking-cycle.

However, a series of below-forecast data prints may sap the appeal of the greenback, and EUR/USD may stage a near-term rebound as market participants scale back bets for four Fed rate-hikes in 2018.

Impact that the U.S. GDP report has had on EUR/USD during the previous quarter

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

4Q A 2017 |

01/26/2018 13:30:00 GMT |