Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

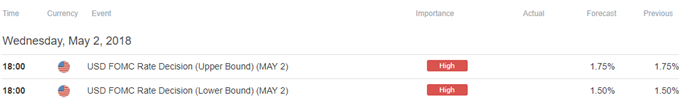

- Federal Open Market Committee (FOMC) to Keep Benchmark Interest Rate in Current Range of 1.50% to 1.75%. Will Chairman Jerome Powell & Co. Alter the Forward-Guidance for Monetary Policy?

- EUR/USD[1] Rate Extends Lower Highs & Lows, Eyes 2018-Low as Bearish Momentum Gathers Pace.

The Federal Open Market Committee (FOMC) interest rate decision may trigger a bearish reaction in the U.S. dollar[2] as the central bank is widely expected to retain the current policy in May.

More of the same from the FOMC[3] is likely to dampen the appeal of the greenback as it saps bets for four rate-hikes in 2018, and the Chairman Jerome Powell and Co. may largely emphasize that ‘the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data’ amid the ongoing slack in the real economy. In turn, the dollar may ultimately face a bearish scenario, with EUR/USD at risk of paring the decline from the previous month if the central bank merely sticks to the current script.

However, the FOMC may sound more hawkish ahead of its next quarter meeting in June as recent data prints point to above-target inflation, and fresh remarks from central bank may heighten the appeal of the greenback if the committee shows a greater willingness to extend the hiking-cycle. Sign up and join DailyFX Chief Strategist John Kicklighter LIVE[4] to cover the FOMC interest rate decision.

Impact that the FOMC rate decision has had on EUR/USD during the last meeting

|

Period |

Data Released |