AUSTRALIAN DOLLAR TALKING POINTS

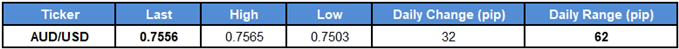

AUD/USD[1] gaps higher at the start of the week as U.S. Treasury Secretary Steven Mnuchin[2] announces that the trade war with China, Australia’s largest trading partner, is ‘on hold,’ and the pair may stage a larger rebound over the coming days as the bearish momentum from earlier this year continues to unravel.

With that said, aussie-dollar may threaten the range-bound price action from earlier this month, but fresh comments coming out of the Reserve Bank of Australia (RBA) may rattle the recent rebound in the exchange rate should the central bank continue to tame expectations for a 2018 rate-hike.

Bearish AUD/USD Momentum Continues to Unravel Ahead of Reserve Bank of Australia (RBA) Rhetoric

Even though the economic docket remains fairly light for the remainder of the month, market participants are likely to turn their attention to RBA Governor Philip Lowe as he’s scheduled to speak later this week, and the central bank head may largely endorse a wait-and-see approach ahead of the next meeting on June 5 as ‘the low level of interest rates is continuing to support the Australian economy.’

More of the same from Governor Lowe may dampen the appeal of the Australian dollar[3] as the central bank remains in no rush to normalize monetary policy, and the RBA may stick to the sidelines throughout the 2018 as ‘inflation is likely to remain low for some time, reflecting low growth in labour costs and strong competition in retailing.’ In turn, a batch of dovish comments may undermine the rebound from the monthly-low (0.7412), but recent developments in the Relative Strength Index (RSI) highlights the risk for a larger correction in AUD/USD as