Trading the News: Canada Quarterly Gross Domestic Product (GDP)

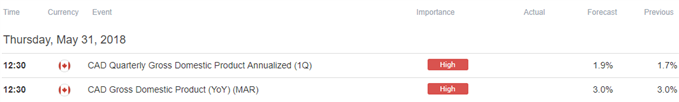

Updates to Canada’s Gross Domestic Product (GDP) report may fuel the recent decline in USD/CAD[1] as the growth rate is projected to pick up to an annualized 1.9% from 1.7% during the last three-months of 2017.

USD/CAD continues to pullback from the May-high (1.3047) following the Bank of Canada (BoC) interest rate decision as the central bank adopts a more hawkish tone, and signs of stronger growth may encourage Governor Stephen Poloz and Co. to further normalize monetary policy in 2018 as ‘inflation in Canada has been close to the 2 per cent target and will likely be a bit higher in the near term than forecast in April.’

In turn, an upbeat GDP report may spark a bullish reaction in the Canadian dollar[2], with USD/CAD at risk for a larger pullback as market participants boost bets for an imminent BoC rate-hike. However, a dismal development may undermine the recent decline in USD/CAD as it encourages the BoC to stick to the wait-and-see approach, and the central bank may merely attempt to buy more time at the next meeting on July 11 as officials pledge to ‘look through the transitory impact of fluctuations in gasoline prices.’

Impact that Canada GDP has had on USD/CAD during the previous quarter

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

4Q 2017 |