JAPANESE YEN TALKING POINTS

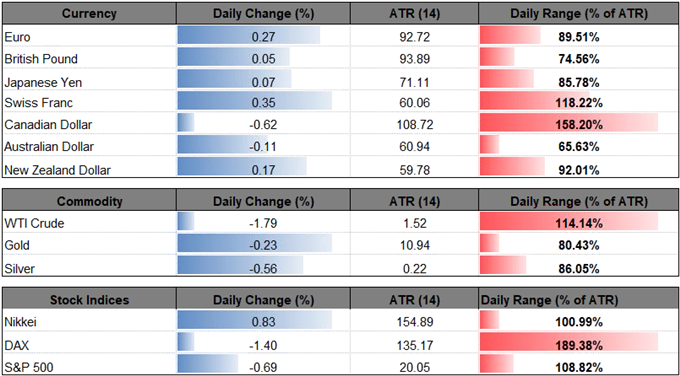

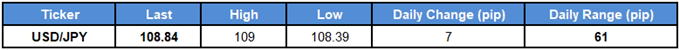

USD/JPY[1] holds a narrow range even as the Trump Administration plans to impose tariffs on imported aluminum and steel from Canada, Mexico, and the European Union (EU)[2], and the updates to the U.S. Non-Farm Payrolls (NFP) report may keep the exchange rate afloat as the economy is expected to add 190K jobs in May.

DOLLAR-YEN RATE HOLDS STEADY, FED OUTLOOK REMAINS UNCHANGED AHEAD OF U.S. NON-FARM PAYROLLS (NFP)

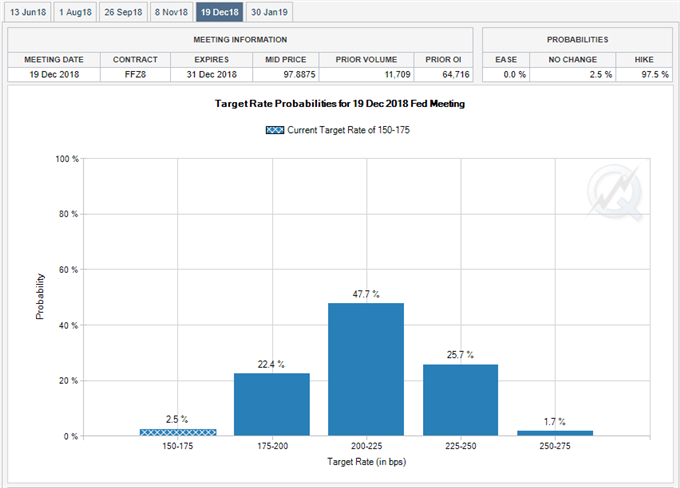

Indications of full-employment may push the Federal Reserve to expand the hiking-cycle as price growth is expected to run above target over the coming months, and the central bank may adopt a more hawkish tone in the second-half of the year as it largely achieves the dual mandate for monetary policy.

However, signs of subdued wage growth may dampen the appeal of the greenback as Average Hourly Earnings are projected to hold steady at an annualized 2.6%, and the updates may do little to alter the monetary policy outlook as ‘market-based measures of inflation compensation remain low.’ With that said, the Federal Open Market Committee[3] (FOMC) may increase its efforts to anchor expectations, and Chairman Jerome Powell and Co. may continue to project a longer-run neutral rate of 2.75% to 3.00% at the next quarterly meeting in June as ‘inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term.’

In response, Fed Fund Futures may continue to highlight narrowing bets for four rate-hikes in 2018, with USD/JPY still at risk of facing a larger decline as both price and the Relative Strength Index (RSI) snap the bullish formations from earlier this year.