GOLD TALKING POINTS

Gold prices[1] are trading back below the $1300 handle as fresh developments coming out of the U.S. economy[2] boost bets for higher interest rates, and market participants may continue to shun the precious metal as the Federal Reserve appears to be on course to normalize monetary policy throughout the second-half of the year.

Fundamental Forecast for Gold: Bearish

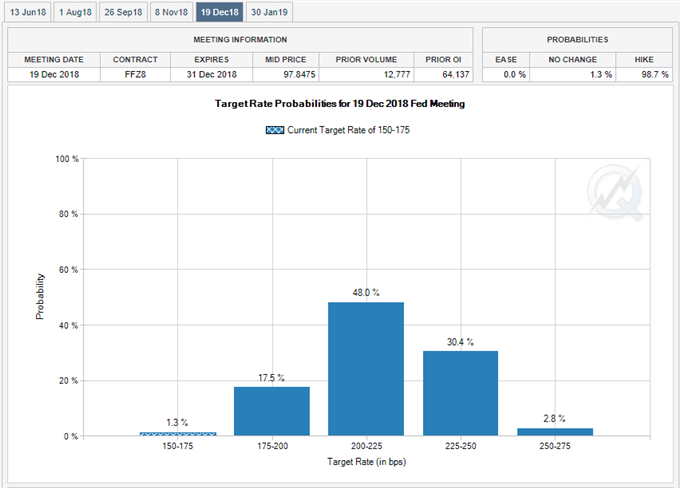

With limited U.S. data prints on tap for the week ahead, gold prices may face range-bound conditions especially as the Federal Open Market Committee (FOMC) enters its quiet period ahead of the June 13 interest rate decision, but the material shift in market behavior may continue to take shape over the near-term as the central bank is widely expected to deliver a 25bp rate-hike later this month.

As a result, gold prices remain vulnerable ahead of the quarterly meeting as Chairman Jerome Powell & Co. plan to phase out the forward-guidance for monetary policy, and the updated projections from Fed officials may produce fresh headwinds for bullion if the central bank shows a greater willingness to extend the hiking cycle.

Keep in mind, Fed Fund Futures continue to reflect limited expectations for four rate-hikes in 2018 as the FOMC[3] looks to tolerate above-target inflation for the foreseeable future, but near-term price action keeps the broader outlook tilted to the downside as both price and the Relative Strength Index (RSI) extend the downward trends from earlier this year,

Gold Daily Chart

Bullion may continue to carve a fresh string of lower highs & lows as it marks a failed attempt to push back the 200-Day ($1307) simple-moving average (SMA), and