Australian Dollar Talking Points

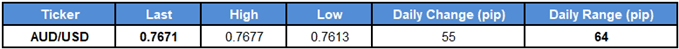

AUD/USD[1] extends the advance from earlier this week as updates to Australia’s Gross Domestic Product (GDP) report instills an improved outlook for the region, and the exchange rate may continue to retrace the decline from the April-high (0.7813) as it appears to be on course to threaten the downward trend from earlier this year.

AUD/USD Forecast: Break of Bearish Trendline to Fuel Larger Recovery

Even though the RBA sticks to a wait-and-see approach for monetary policy, the reaction to the above-forecast GDP print[2] increases the risk for a larger recovery in AUD/USD as signs of stronger growth puts pressure on the Reserve Bank of Australia (RBA) to lift the official cash rate (OCR) off of the record-low.

Keep in mind, Governor Philip Lowe & Co. appear to be in no rush to alter the forward-guidance for monetary policy as ‘inflation is low and is likely to remain so for some time,’ and the RBA Minutes due out on June 19 may continue to tame bets for an imminent rate-hike as ‘the Board judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.’

However, RBA officials may start to change their tune in the second-half of the year as ‘members agreed that it was more likely that the next move in the cash rate would be up, rather than down,’ with AUD/USD at risk of staging a more meaningful recovery over the coming days as it appears to be on track to threaten the downward trend from earlier this year.

AUD/USD Daily Chart