TALKING POINTS – G7, TRUMP, US DOLLAR, YEN, TRADE WAR

- US Dollar[1], Yen aim higher as trade war fears swell before G7

- Aussie Dollar down as trade war jitters shake APAC markets

- Canadian Dollar[2], Mexican Peso fall on worries about NAFTA

The sentiment-linked Australian Dollar[3] underperformed in otherwise quiet Asia Pacific trade as risk appetite soured, with the MSCI regional benchmark equity index shedding 1.4 percent. Investors’ dour mood likely reflects worries about the looming G7 leaders’ summit getting underway in Quebec.

The gathering is shaping up to be a contentious affair. The US decision to let lapse aluminum and steel tariff exemptions for Canada and the European Union will supply the backdrop. Warning shots from Paris and Ottawa were met with a barrage of bellicose tweets from President Trump earlier today.

Indeed, Mr Trump’s displeasure with Canada’s Prime Minister Justin Trudeau was so specific and pronounced that the Canadian Dollar fell amid worries that NAFTA renegotiation efforts may be derailed. Tellingly, the Mexican Peso declined in tandem.

Investors previously sanguine about the summit[4] may now be inspired to adopt a more defensive posture, producing a more pronounced risk-off drive in the final hours of the trading week. That bodes ill for commodity-bloc currencies while haven flows boost the Japanese Yen[5] and US Dollar.

See our free guide to learn how to use economic news in your trading strategy[6]!

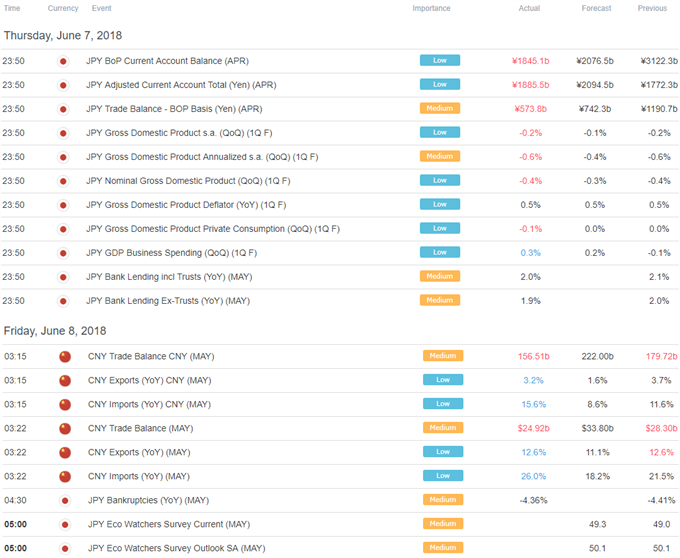

ASIA PACIFIC TRADING SESSION

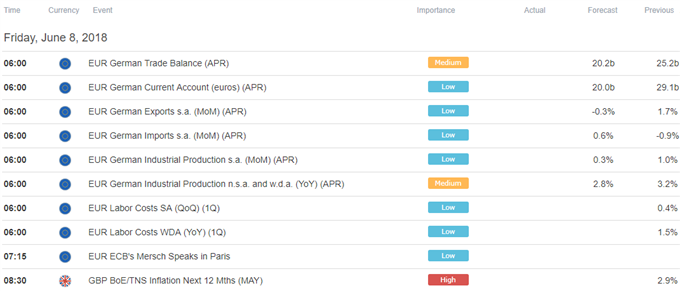

EUROPEAN TRADING SESSION

** All times listed in GMT. See