Trading the News: Canada Net Change in Employment

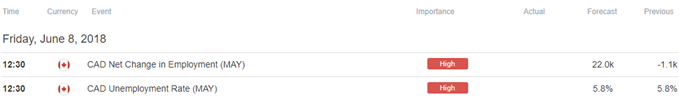

A 22.0K rebound in Canada Employment may trigger a pullback in USD/CAD[1] as it puts pressure on the Bank of Canada (BoC) to implement higher borrowing-costs sooner rather than later.

A positive development is likely to boost the appeal of the Canadian dollar[2] as it instills an improved outlook for growth and inflation, and the BoC may show a greater willingness to further normalize monetary policy in the second-half of 2018 as ‘activity in the first quarter appears to have been a little stronger than projected.’ The recent shift in central bank rhetoric suggests the BoC will continue to adjust monetary policy as ‘higher interest rates will be warranted to keep inflation near target,’ and USD/CAD stands at risk of facing a larger correction over the days ahead amid the string of failed attempts to test the March-high (1.3125).

With that said, the Canadian dollar may trade on a firmer footing ahead of the next BoC meeting on July 11, but another unexpected decline in employment may push USD/CAD back towards the monthly-high 1.3067) as it saps bets for an imminent rate-hike.

Impact that Canada’s Employment report has had on USD/CAD during the last print

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

APR 2018 |

05/11/2018 12:30:00 GMT |

20.0K |

-1.1K |