British Pound Talking Points

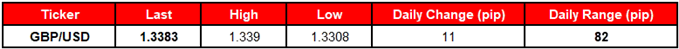

The British Pound[1] slips to a fresh weekly-low even as the U.K. Consumer Price Index (CPI) holds steady at an annualized 2.4% in May, and GBP/USD may continue to give back the advance from the May-low (1.3204) as it extends the recent series of lower highs & lows.

GBP/USD Lags Behind as U.K. CPI Fails to Boost Bets for BoE Rate-Hike

The British Pound is back under pressure as the U.K. House of Lords prepares to vote on the Brexit bill amendment[2], and recent price action raises the risk for a further decline in GBP/USD as data prints surrounding the real economy dampen bets for an imminent Bank of England (BoE) rate-hike.

Signs of sticky price growth should keep the BoE on track to implement higher borrowing-costs as ‘an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to its target at a conventional horizon,’ and Governor Mark Carney and Co. may continue to strike a hawkish tone over the coming months as ‘wage growth and domestic cost pressures are firming gradually, broadly as expected.’

However, limited signs of heightening price pressures may encourage the Monetary Policy Committee (MPC) to keep the benchmark interest rate on hold at the next meeting on June 21, and more of the same from the central bank is likely to produce headwinds for the British Pound as market participants push out bets for the next BoE rate-hike.

With that said, updates to the U.K. Retail Sales report may keep GBP/USD under pressure ahead of the BoE meeting as household consumption is expected to narrow to 0.3% from 1.3% in April, and