Japanese Yen Talking Points

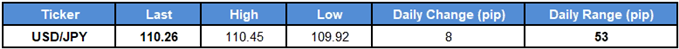

USD/JPY pares the decline following Federal Open Market Committee (FOMC) rate decision as fresh data prints coming out of the U.S. economy encourage an improved outlook for growth and inflation, but recent price action raises the risk for range-bound conditions as the dollar-yen[1] exchange rate snaps the series of higher highs & lows from earlier this week.

Post-FOMC USD/JPY Weakness to Persist as Bullish Sequence Snaps

USD/JPY trades on a firmer footing as the U.S. Retail Sales report instills an improved outlook for the economy, with household spending increasing 0.8% in May versus forecasts for a 0.4% print.

The positive development should keep the FOMC[2] on course to deliver four rate-hikes in 2018 as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term,’ and it seems as though the central bank will continue to strike a hawkish tone over the coming months as officials achieve their dual mandate for full-employment and price stability.

However, the reaction to the FOMC interest rate decision[3] undermines the stickiness in the USD/JPY exchange rate as Chairman Jerome Powell & Co. continue to project a longer-run neutral Fed Funds rate of 2.75% to 3.00%, and the updates suggest the central bank will refrain from adopting a more aggressive approach as the committee pledges to ‘assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.’ At the same time, the Bank of Japan (BoJ) meeting may keep