The British Pound is down nearly 1.4% from the monthly high as a shakeup in the UK parliament fueled ongoing concerns regarding the Brexit conditions[1]. Despite the decline, price continues to trade just above a long-term, critical support confluence and IF prices are heading higher, Cable needs to hold these lows. Here are the updated targets and invalidation levels that matter for GBP/USD[2] heading into the close of the week. Review this week’s Strategy Webinar[3] for an in-depth breakdown of this setup and more.

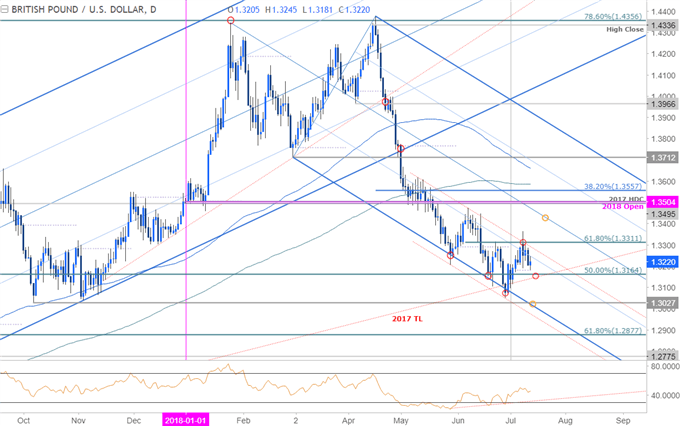

GBP/USD Daily Price Chart

Technical Outlook: In my most recent Weekly Technical Perspective on the British Pound[4], we highlighted how GBP/USD had failed multiple attempts to break below a key support confluence around ~1.3164. The rebound off pitchfork support failed at the upper parallel (red) but the pullback continues to trade just above this key support zone.

IF Sterling has turned the corner, we’ll want to see a weekly close above this threshold. Daily resistance remains steady at 1.3311- a close above this shifts the focus towards the median-line[5] and more significant resistance at 1.3495. A break lower risks substantial losses for the Pound with such a scenario targeting the lower parallel / October lows at 1.3027.

New to Trading? Get started with this Free Beginners Guide[6]

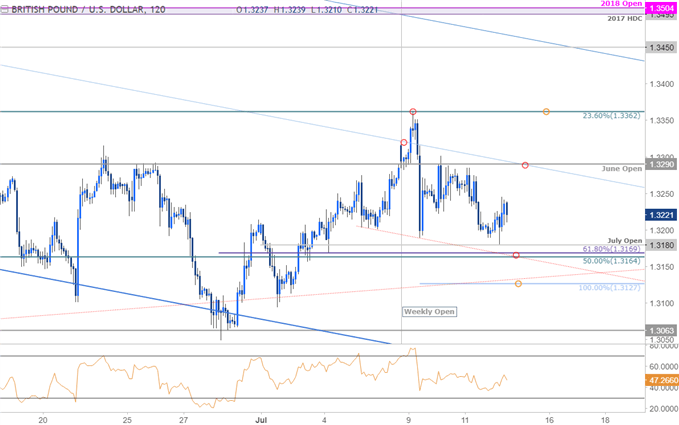

GBP/USD 120min Price Chart

Notes: A closer look at price action sees Cable still trading within the weekly opening range. It’s the battle of the monthly opens with the immediate range in focus between 1.3180-1.3290. On a slide lower, 1.3164 and 1.3127 are