Japanese Yen Talking Points

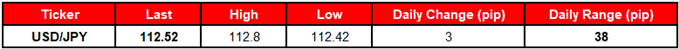

USD/JPY climbs to a fresh monthly-high (112.80) ahead of the semi-annual Humphrey-Hawkins testimony, with the dollar-yen[1] exchange now at risk of making a run at the 2018-high (113.39) as it extends the series of higher highs & lows from earlier this week.

USD/JPY Overbought Signal Persists Ahead of Fed Chairman Testimony

Despite the growing threat of a trade war[2], recent comments from Chairman Powell suggest the Federal Open Market Committee[3] (FOMC) will stay on course to further normalize monetary policy as the U.S. economy is in a ‘good place.’

In turn, Chairman Powell may continue to strike a upbeat tone in front of U.S. lawmakers as the central bank head pledges to ‘work in a strictly nonpolitical way, based on detailed analysis,’ and a batch of hawkish comments is likely to boost the appeal of the greenback as the Fed appears to be on track to implement four rate-hikes in 2018.

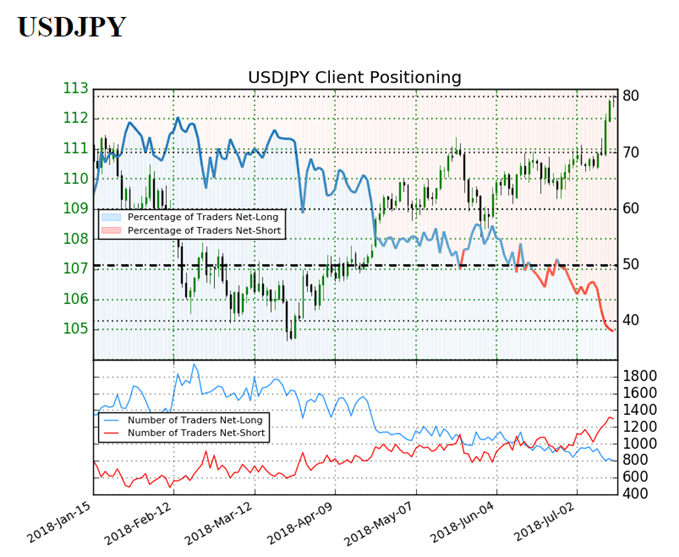

Keep in mind, the IG Client Sentiment report[4] shows the retail crowd has remained net-short since June 28 when USD[5]/JPY traded near the 110.50area even though price has moved 1.9% higher since then.

It looks as though the swing in retail positioning will continue as the number of traders net-long is 5.2% lower than yesterday and 20.3% lower from last week, while the number of traders net-short is 5.0% higher than yesterday and 17.0% higher from the previous week. The recent shift in sentiment offers a contrarian view as retail traders appear to be going against the current trend and continue to boost their net-short exposure,