Fundamental Forecast for USOIL: Bullish

Talking Points:

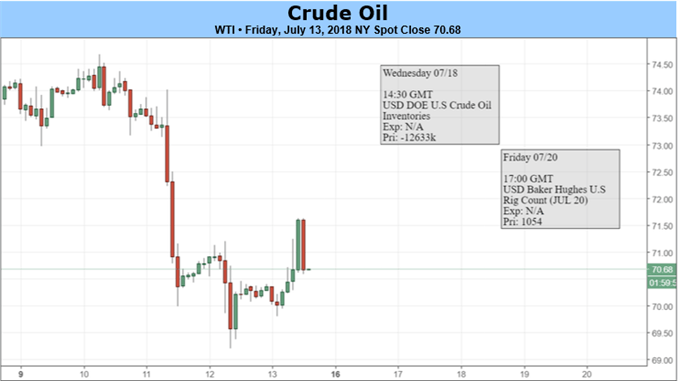

- The ONE Thing: Crude oil traders witnessed a clearly bullish report as the weekly Department of Energy data showed an aggressive draw at -12.633mn barrels against the expected -3.9mn. The draw was the largest seen since September 2016.

- Per BHI, U.S. Oil Rig Count remains flat at 863, US total count at 1,054

- The factors that seem to be holding back prices were likely the build in distillates of +4.125mn barrels in addition to the broader risk sentiment dip that was seen this week on the escalation of trade wars.

- Crude sees the largest intraweek decline in five months

The current uptrend in crude oil is a little over a year old, and traders remain on the fence as to whether the price of Oil[1] is about to take a new leg higher toward $77/bbl for WTI or $89/bbl for Brent. The hesitancy to bid prices higher despite the massive DoE draw on Wednesday and no new oil rigs added on Friday is likely due to the options skew that is pricing less upside potential for oil and weakening physical structure as backwardation lessens.

Another dark cloud hanging over the commodities market is the trade war. The dark cloud was evidenced by China's crude imports falling in June by 12% to 8.39 million b/d, the lowest level since December, per the General Administration of Customs in Beijing.

As of Friday, the weekly loss on WTI & Brent crude was 3.35 & 2.14% respectively, which is up from an intraweek low of 5% after US President Trump applied tariffs on nearly