FX Talking Points:

- USD/CAD[1] Initiates Bearish Series Following Mixed U.S. & Canada Data. 2018 Rebound at Risk as Bullish Trends Falter.

- USD/JPY[2] Stages Larger Rebound Amid U.S. & North Korea Talks. Price & Relative Strength Index (RSI) Threaten Bearish Formations From Earlier This Year.

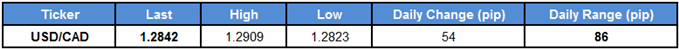

USD/CAD INITIATES BEARISH SERIES FOLLOWING MIXED U.S. & CANADA DATA

USD/CAD slips to fresh weekly lows amid the mixed set of data prints coming out of the U.S. and Canadian economy, and recent price action raises the risk for a further decline in the dollar-loonie exchange rate as it carves a fresh series of lower highs & lows.

The 15.4K expansion in Canada Employment is likely to have a limited impact on the monetary policy outlook as the Bank of Canada (BoC) reverts back to a wait-and-see approach, and Governor Stephen Poloz and Co. may continue to tame expectations for an imminent rate-hike as a deeper look at the report shows the 39.3K contraction in full-time positions being offset by a 54.7K expansion in part-time employment.

In contrast, the updates to the U.S. Non-Farm Payrolls (NFP) report should keep the Federal Open Market Committee (FOMC) on track to further normalize monetary policy as the economy adds 313K jobs in February, but Chairman Jerome Powell and Co. may curb speculation for four rate-hikes in 2018 as Average Hourly Earnings narrows to an annualized 2.6% from a revised 2.8% in January. Signs of lackluster wage growth may encourage a growing number of Fed officials to project a more shallow course for the benchmark interest rate as ‘a couple of members expressed concern about the outlook for inflation, seeing little evidence of a meaningful improvement in the underlying trend in inflation, measures of inflation expectations, or wage growth,’ and the greenback stands at risk of facing a more bearish fate over the near-term should the FOMC[3] implement a dovish rate-hike at the March meeting.

With that said, the advance from the year-low (1.2247) appears to have run its course following the series of failed attempts to close above the 1.2980 (61.8% retracement) to 1.3030 (50% expansion) region, with USD/CAD at risk for further losses as both price and the Relative Strength Index (RSI) threaten the upward trends carried over from the previous month.

USD/CAD Daily Chart

- May see USD/CAD continue to carve a series of lower highs & lows as it snaps the weekly range, but failure to close below 1.2830 (38.2% retracement) may foster range-bound conditions even as the RSI flashes a bearish signal.

- With that said, need to see a break/close below the 1.2720 (38.2% retracement) to 1.2770 (38.2% expansion) to bring the downside targets back on the radar, with the next region of interest coming in around 1.2620 (50% retracement).