In this series we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. Here are the key levels that matter on the weekly charts for the Euro[1] crosses as we head deeper into March trade.

Check out our New 2018 projectionsin our Free DailyFX Trading Forecasts[2]

EUR/USD Weekly Price Chart

Notes: In late-February we noted that Euro was probing into an area of slope support and that losses were likely to be limited[3] while above former pitchfork resistance (blue). Indeed price dipped into the 1.2167 support barrier before reversing higher with prices rallying nearly 2% off the recent lows. Initial resistance stands with the 2018 high-day close at 1.2409 with key resistance steady at 1.2598 where the 2008 trendline resistance converges on the 61.8% retracement of the 2014 decline.

Bottom Line: The broader focus remains on a break of the 1.2167-1.2598 range for guidance with the risk weighted to the topside while above confluence support at 1.2167. From a trading standpoint, I’ll favor fading weakness for stretch into multi-year channel resistance – look for reaction there.

New to ForexTrading? Get started with this Free Beginners Guide[4]

EUR/JPY Weekly Price Chart

Notes: EUR/JPY has been trading within the confines of a well-defined ascending pitchfork formation[5] extending off the July 2016 low with prices breaking below the median-line in early February. The decline reversed off confluence support last week at 129.30/60 where the 52-week and 200-week moving averages converge on basic parallel[6] support. Initial resistance stands at the January lows at 133.02 backed by 134.29 and the 2018 open at 135.16. Note that weekly RSI profile turned just ahead of 40 and suggests the broader up-trend remains intact from a momentum standpoint.

Bottom line: The immediate risk is higher but ultimately a breach through the median-line / yearly open would be needed to mark resumption of the broader uptrend. Critical support and broader bullish invalidation now rests with the 2015 low-week reversal close at 128.42.

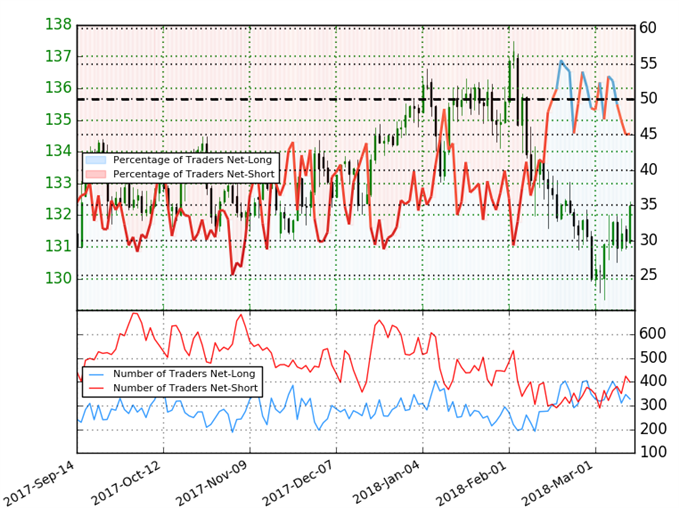

EUR/JPY IG Client Positioning

- A summary of IG Client Sentiment[7]shows traders are net-short EURJPY- the ratio stands at -1.22 (45.1% of traders are long) – weak bullishreading

- Long positions are 2.4% lower than yesterday and 11.9% lower from last week

- Short positions are 1.3% higher than yesterday and unchanged from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURJPY prices may continue to rise. Traders are further net-short than yesterday