Talking Points:

- March Fed rate hike odds remain at 100%, but odds for four hikes in 2018 are still below 40%.

- The US Dollar has followed US Treasury rates less than it has served as a hedge against movement in US equity markets.

- See the full DailyFX Webinar Calendar[1] for upcoming strategy sessions.

Looking to learn more about how central banks impact FX markets? Check out the DailyFX Trading Guides[2].

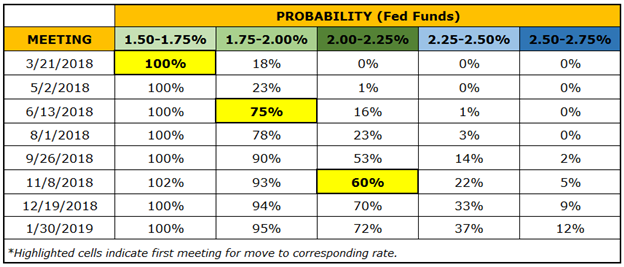

Ahead of next week’s FOMC[3] meeting, Fed funds futures are pricing in a 100% chance of a rate hike – as they have since the start of 2018. It should be no surprise then that the direction of the US Dollar is not contingent on the Fed raising rates but rather what expectations are set for the path of rate hikes down the line. Currently, rates markets are pricing in additional 25-bps hikes in June and November, with a 33% chance for a fourth rate hike in 2018 by December.

Table 1: Fed Funds Rate Hike Expectations (March 15, 2018)

The biggest source of volatility for the US Dollar will come from the updated Summary of Economic projections, the first released during the tenure of newly-minted Fed Chair Jerome Powell. At his testimonies to Congress in February, Chair Powell suggested that recent developments in the US economy, including a more stimulative fiscal policy vis-à-vis the Trump tax cuts, will result in both growth and inflation expectations being upgraded.

While said developments should be positive for the US Dollar, there has been a stark disconnect between the direction of US Treasury yields and the greenback – higher yields have not Fed into a stronger currency. Ultimately, the link between US equity markets and FX markets will prove to be the key driver.

Price Chart 1: DXY[4] Index Daily Timeframe (August 2017 to March 2018)

It would stand to reason that given the inverse relationship between the S&P 500[5], for example, and the US Dollar since the start of 2018, that fears of a faster Fed tightening cycle leading to a selloff in stocks would prove to be the most fertile grounds for US Dollar gains.

With a backdrop as such, USD/JPY[6] seems poised to continue its downtrend since the start of the year while pairs like EUR/USD[7] and GBP/USD[8] should remain relatively rangebound. Similarly, it would appear that the DXY Index may not find the FOMC meeting as the catalyst it needs to break 91.01, the 2017 low that has capped price action ever since its break on January 12 (failed morning doji star candle cluster on January 15 to 17 and a bearish key reversal on March