Talking Points:

- Yen gains as China chemicals import levy sinks Japanese stocks

- Australian Dollar[1] down with iron ore, US Dollar[2] retracing gains

- G20 summit in focus, Davis/Barnier meeting may boost Pound

The Yen outperformed in otherwise staid Asia Pacific trade. Japan’s Nikkei 225[3] stock index declined, offering a lift to the standby anti-risk currency. China announced that it will levy an anti-dumping levy on chemicals imports from Japan, which may have sparked the selloff. South Korea was also targeted, and its KOSPI equitiesbenchmark likewise fell. Duties will range from 16 to 190 percent.

The Australian Dollar fell, tracking a drop in iron ore prices. The metal is one of Australia’s top-two exports, with moves in price sometimes interpreted as having knock-on effects for overall growth and thereby RBA policy. Needless to say, the latter echoes in the exchange rate. The US Dollar also fell in what looked like a correction following a sharp rally in the final 48 hour of last week[4].

Looking ahead, headlines from a meeting of G20 finance ministers and central bank governors getting underway in Buenos Aires, Argentina may take the spotlight. Trade war jitters may return[5] as global officials spar with the US over the recent hike in steel and aluminum tariffs, battering already fragile market sentiment. Indeed, S&P 500[6] and FTSE 100[7] futures are pointing tellingly lower, hinting the Yen may extend gains.

A fruitful outcome to a meeting between the top UK Brexit negotiator David Davis and his EU counterpart Michel Barnier might brighten the mood a bit. They may unveil an agreement on the terms of a transition period to follow the UK’s exit from the regional bloc, allowing for gradual phasing-in of the new relationship (whatever that may ultimately look like). The British Pound[8] might enjoy a lift as well.

See our free guide to get help with building confidence in your FX trading strategy[9]!

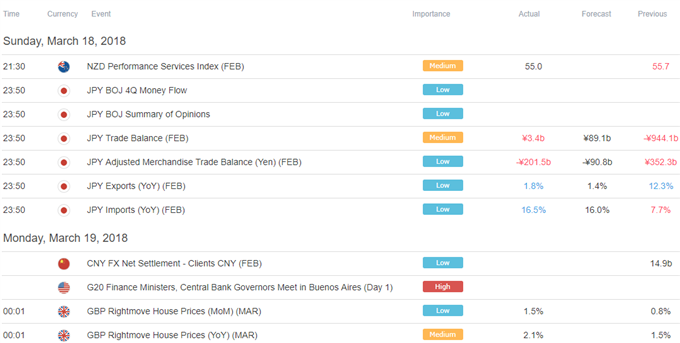

Asia Pacific Trading Session

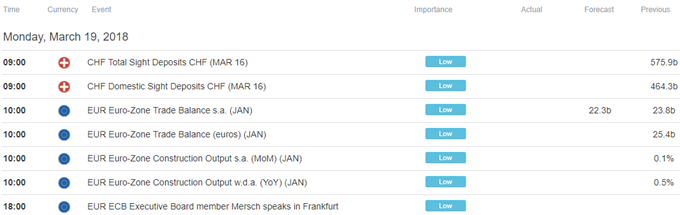

European Trading Session

** All times listed in GMT. See the full economic calendar here[10].

FX TRADING RESOURCES

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak[11] on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE[12]

References

- ^ Australian Dollar (www.dailyfx.com)

- ^ US Dollar (www.dailyfx.com)

- ^ Nikkei 225 (www.dailyfx.com)

- ^ sharp rally in the final 48 hour of last week (www.dailyfx.com)

- ^ Trade war jitters may return (www.dailyfx.com)

- ^