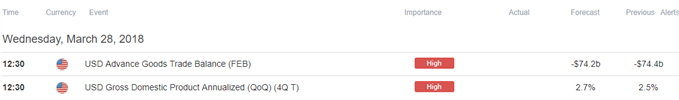

- 4Q U.S. Gross Domestic Product (GDP) to Expand Annualized 2.7% Versus Initial Forecast of 2.5%. Core Personal Consumption Expenditure (PCE) to Hold Steady at 1.9%.

- EUR/USD[1] Preserves Bullish Sequence. 2018-High Remains on the Radar

Trading the News: U.S. Gross Domestic Product (GDP)

Updates to the 4Q U.S. Gross Domestic Product (GDP) report may heighten the appeal of the greenback as the fresh revision is expected to show the economy growing an annualized 2.7% versus an initial forecast of 2.5%.

Signs of stronger-than-expected activity may encourage the Federal Open Market Committee[2] (FOMC) to deliver one rate-hike at every quarterly meeting, and Chairman Jerome Powell and Co. may continue to prepare U.S. households and businesses for higher borrowing-costs as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate.’ In turn, a batch of positive developments may foster a bullish reaction in the U.S. dollar[3] as the central bank appears to be on course to further normalize monetary policy over the coming months.

However, a set of below-forecast prints may trigger a bearish reaction in the greenback as it drags on interest-rate expectations, with EUR/USD at risk of staging a more meaningful advance over the coming days as it breaks out of a narrow range.

Impact that the U.S. GDP report had on EUR/USD during the previous quarter

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

3Q F 2017 |

12/21/2017 13:30:00 GMT |

3.3% |

3.2% |

+6 |

+16 |

3Q 2017 U.S. Gross Domestic Product (GDP)

EUR/USD 5-Minute Chart

The final reading for the 3Q U.S. Gross Domestic Product (GDP) report showed an unexpected downward revision in the growth rate, with the economy expanding an annualized 3.2% versus an initial forecast of 3.3%. A deeper look at the report showed the gauge for Personal Consumption also narrowing to 2.2% from earlier projections of 2.3%, with the core Personal Consumption Expenditure (PCE), the Fed’s preferred gauge for inflation, slowing to 1.3% from 1.4% during the same period. The initial reaction was short-lived, with EUR/USD pulling back towards the 1.1850 region, but the pair regained its footing during the North American trade to end the day at 1.1874.

EUR/USD Daily Chart

EUR/USD pulls back from a fresh weekly-high (1.2476), but the near-term outlook remains tilted to the topside as it breaks out of

EUR/USD pulls back from a fresh weekly-high (1.2476), but the near-term outlook remains tilted to the topside as it breaks out of