The Australian Dollar[1] has rallied nearly 2% against the Japanese Yen[2] since the March lows with the advance taking price into near-term confluence resistance. We’re looking for a reaction at this pivot with a breach above needed to keep the immediate long-bias in play. That said, this inflection point could also prove terminal for the correction off the lows- for now the focus is on resistance at 82.15.

AUD/JPY Daily Price Chart

Technical Outlook: In this week’s Technical Perspective[3], we highlighted the broader outlook for AUD/JPY with our near-term focus on resistance into the 82-handle. Price is testing this range today. The daily chart isn’t all that impressive here but does highlight some key levels IF price breaks higher at 82.52 & the 83-handle.

Key support remains with the 61.8% retracement / low-day close at 80.57/58- a break below this threshold targets, “79.45 and the median-line confluence around 78.50s. Note that AUDJPY made a new multi-year low while AUDUSD[4] has not; a disparity that often manifests itself at larger turns in price- keep a close eye here.”

New to Forex[5] Trading? Get started with this Free Beginners Guide[6]

AUD/JPY 120min Price Chart

Notes: A closer look at price action see’s AUD/JPY trading within the confines of a well-defined ascending channel formation with the upper parallel further highlighting resistance today around 82.15. Note that the momentum profile has exhibited a change in behavior with the oscillator finding support ahead of 40 after reaching its highest levels since mid-March (constructive).

Why does the average trader lose? Avoid these Mistakes in your trading[7]

Bottom line: The immediate risk is higher but we’ll be looking for a near-term reaction here at confluence resistance. A breach above looks for a stretch into 82.52 & 83- both levels of interest for exhaustion. If we fail here again, look for interim support at 81.26 backed by the lower parallel, currently around ~80.95 (near-term bullish invalidation). Ultimately a break below 80.57 would be needed to mark resumption of the broader downtrend.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy[8]

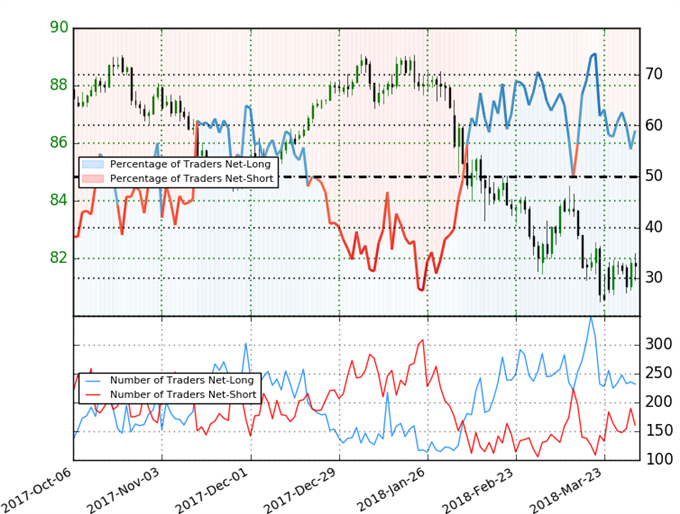

AUD/JPY IG Client Positioning

- A summary of IG Client Sentiment[9] shows traders are net-long AUDJPY- the ratio stands at +1.44 (59.0% of traders are long) –weak bearishreading

- Retail has remained net-long since Mar 15th; price has moved 2.4% lower since then

- Long positions are 1.8% higher than yesterday and 12.8% lower from last week